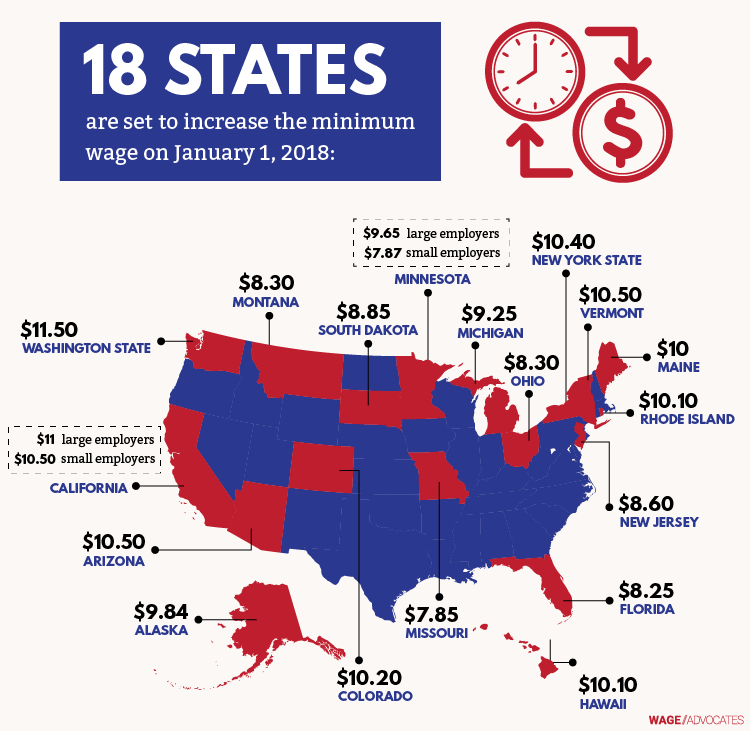

At least 18 states and 20 cities will increase their minimum wages on January 1, 2018, according to the National Employment Law Project. And later in the New Year, another 3 states and an additional 18 cities or counties will do the same, responding to new laws or ballot initiatives that have compelled labor officials to gradually increase base-pay for workers or peg the minimum wage to rising inflation rates.

Feel free to share our minimum wage infographic on your own site. Just copy and paste the code below:

2018 State Minimum Wage Laws & Overtime Requirements

Here’s a full rundown of the changes we can expect in 2018 and whether any of them will affect your pay check. You can jump to your state by clicking one of these links:

State Minimum Wage Increases In 2018

Alaska

Effective: January 1, 2018

- 2018 Minimum Wage – $9.84

- 2017 Minimum Wage – $9.80

Alaska doesn’t allow employers to use a tip credit.

Arizona

Effective: January 1, 2018

- 2018 Minimum Wage – $10.50 per hour

- 2017 Minimum Wage – $10 per hour

- 2018 Tipped Minimum Wage – $7.50 per hour

- 2017 Tipped Minimum Wage – $7 per hour

California

Effective: January 1, 2018

- 2018 Minimum Wage

- $11 per hour – large employers – 26 or more employees

- $10.50 per hour – small employers – 25 or fewer employees

California law does not allow employers to take a tip credit. Every employee in the State, including workers who regularly receive tips, are entitled to the full minimum wage active in their city or county.

Colorado

Effective: January 1, 2018

- 2018 Minimum Wage – $10.20 per hour

- 2017 Minimum Wage – $9.30 per hou

- 2018 Tipped Minimum Wage – $7.18 per hour

- 2017 Tipped Minimum Wage – $6.28 per hour

Florida

Effective: January 1, 2018

- 2018 Minimum Wage – $8.25 per hour

- 2017 Minimum Wage – $8.10 per hour

- 2018 Tipped Minimum Wage – $5.23 per hour

- 2017 Tipped Minimum Wage – $5.08 per hour

Hawaii

Effective: January 1, 2018

- 2018 Minimum Wage – $10.10 per hour

- 2017 Minimum Wage – $9.25 per hour

- 2018 Tipped Minimum Wage – $9.35 per hour

- 2017 Tipped Minimum Wage – $8.50

Maine

Effective: January 1, 2018

- 2018 Minimum Wage – $10 per hour

- 2017 Minimum Wage – $9 per hour

Even though Maine’s general minimum wage is increasing in 2018, the State’s minimum wage allowance for tipped employees will stay the same.

- 2018 Tipped Minimum Wage – $5 per hour

- 2017 Tipped Minimum Wage – $5 per hour

Michigan

Effective: January 1, 2018

- 2018 Minimum Wage – $9.25 per hour

- 2017 Minimum Wage – $8.90 per hour

- 2018 Tipped Minimum Wage – $3.52 per hour

- 2017 Tipped Minimum Wage – $3.38 per hour

Minnesota

Effective: January 1, 2018

- 2018 Minimum Wage

- $9.65 per hour – large employers ($500,000 or more in gross revenue)

- $7.87 per hour – small employers (fewer than $500,000 in gross revenue)

- 2017 Minimum Wage

- $9.50 per hour – large employers

- $7.75 per hour – small employers

Minnesota doesn’t allow employers to take a tip credit.

Missouri

Effective: January 1, 2018

- 2018 Minimum Wage – $7.85 per hour

- 2017 Minimum Wage – $7.70 per hour

- 2018 Tipped Minimum Wage – $3.93 per hour

- 2017 Tipped Minimum Wage – $3.85 per hour

Montana

Effective: January 1, 2018

- 2018 Minimum Wage – $8.30 per hour

- 2017 Minimum Wage – $8.15 per hour

Montana doesn’t let employers use a tip credit.

New Jersey

Effective: January 1, 2018

- 2018 Minimum Wage – $8.60 per hour

- 2017 Minimum Wage – $8.44 per hour

- 2018 Tipped Minimum Wage – $2.13 per hour

- 2017 Tipped Minimum Wage – $2.13 per hour

New York State

Effective: December 31, 2017

- 2018 Minimum Wage – $10.40 per hour

- 2017 Minimum Wage – $9.70 per hour

- 2018 Tipped Minimum Wage – $8.65 per hour

- 2017 Tipped Minimum Wage – $8.10 per hour

Ohio

Effective: January 1, 2018

- 2018 Minimum Wage – $8.30 per hour

- 2017 Minimum Wage – $8.15 per hour

- 2018 Tipped Minimum Wage – $4.15 per hour

- 2017 Tipped Minimum Wage – $4.08 per hour

Rhode Island

Effective: January 1, 2018

- 2018 Minimum Wage – $10.10 per hour

- 2017 Minimum Wage – $9.60 per hour

- 2018 Tipped Minimum Wage – $3.89 per hour

- 2017 Tipped Minimum Wage – $3.89 per hour

South Dakota

Effective: January 1, 2018

- 2018 Minimum Wage – $8.85 per hour

- 2017 Minimum Wage – $8.65 per hour

- 2018 Tipped Minimum Wage – $4.43 per hour

- 2017 Tipped Minimum Wage – $4.33 per hour

Vermont

Effective: January 1, 2018

- 2018 Minimum Wage – $10.50 per hour

- 2017 Minimum Wage – $10 per hour

- 2018 Tipped Minimum Wage – $5.25 per hour

- 2017 Tipped Minimum Wage – $5 per hour

Washington State

Effective: January 1, 2018

- 2018 Minimum Wage – $11.50 per hour

- 2017 Minimum Wage – $11 per hour

Washington State does not allow employers to use a tip credit in calculating worker wages. Employees in the State are always entitled to the fully hourly minimum wage, regardless of their tip income.

City Minimum Wage Changes For 2018

Flagstaff, Arizona

Effective: January 1, 2018

- 2018 Minimum Wage – $11 per hour

- 2017 Minimum Wage – $10.50 per hour

- 2018 Tipped Minimum Wage – $8 per hour

- 2017 Tipped Minimum Wage – $7.50 per hour

Cupertino, California

Effective: January 1, 2018

- 2018 Minimum Wage – $13.50 per hour

- 2017 Minimum Wage – $12 per hour

El Cerrito, California

Effective: January 1, 2018

- 2018 Minimum Wage – $13.60 per hour

- 2017 Minimum Wage – $12.25 per hour

Los Altos, California

Effective: January 1, 2018

- 2018 Minimum Wage – $13.50 per hour

- 2017 Minimum Wage – $12 per hour

Milpitas, California

Silicon Valley industrial hub Milpitas will see two minimum wage increases in the year of 2018 alone.

Effective: January 1, 2018; July 1, 2018

- 2018 Minimum Wage – $12 per hour; $13.50 per hour (July 2018)

- 2017 Minimum Wage – $11 per hour

Mountain View, California

Effective: January 1, 2018

- 2018 Minimum Wage – $15 per hour

- 2017 Minimum Wage – $13 per hour

Oakland, California

Effective: January 1, 2018

- 2018 Minimum Wage – $13.23 per hour

- 2017 Minimum Wage – $12.86 per hour

Palo Alto, California

Effective: January 1, 2018

- 2018 Minimum Wage – $13.50 per hour

- 2017 Minimum Wage – $12 per hour

Richmond, California

Effective: January 1, 2018

- 2018 Minimum Wage – $13.41 per hour

- 2017 Minimum Wage – $12.30 per hour

San Jose, California

Effective: January 1, 2018

- 2018 Minimum Wage – $13.50 per hour

- 2017 Minimum Wage – $12 per hour

San Mateo, California

Effective: January 1, 2018

- 2018 Minimum Wage – $13.50 per hour

- Nonprofit Organizations – $12 per hour

- 2017 Minimum Wage – $12 per hour

- Nonprofit Organizations – $10.50 per hour

Santa Clara, California

Effective: January 1, 2018

- 2018 Minimum Wage – $13 per hour

- 2017 Minimum Wage – $11.10 per hour

Sunnyvale, California

Effective: January 1, 2018

- 2018 Minimum Wage – $15 per hour

- 2017 Minimum Wage – $13 per hour

Minneapolis, Minnesota

On its way to a proposed $15 minimum wage, Minneapolis is set to embrace four different minimum wage rates in 2018, including separate wages for small (gross revenue less than $500,000) and large (gross revenue of $500,000 or more) employers.

Effective: January 1, 2018; July 1, 2018

- 2018 Minimum Wage

- $10 per hour; $11.25 (July) – large employers

- $7.87 per hour; $10.25 (July) – small employers

- 2017 Minimum Wage

- $9.50 per hour – large employers

- $7.75 per hour – small employers

The State of Minnesota does not allow employers to take a tip credit.

Albuquerque, New Mexico

Effective: January 1, 2018

- 2018 Minimum Wage – $8.95 per hour

- 2017 Minimum Wage – $8.80 per hour

- 2018 Tipped Minimum Wage – $5.35 per hour

- 2017 Tipped Minimum Wage – $5.30 per hour

Bernalillo County, New Mexico

Effective: January 1, 2018

- 2018 Minimum Wage – $8.85 per hour

- 2017 Minimum Wage – $8.70 per hour

- 2018 Tipped Minimum Wage – $2.13 per hour

- 2017 Tipped Minimum Wage – $2.13 per hour

Las Cruces, New Mexico

Effective: January 1, 2018

- 2018 Minimum Wage – $9.45 per hour

- 2017 Minimum Wage – $9.20 per hour

- 2018 Tipped Minimum Wage – $3.78 per hour

- 2017 Tipped Minimum Wage – $3.68 per hour

New York City, New York

Effective: December 31, 2017

- 2018 Minimum Wage

- $13 per hour (large employers – 11 or more employees)

- $12 per hour (small employers – fewer than 11 employees)

- $13.50 per hour (fast food workers)

- 2018 Tipped Minimum Wage

- $10.85 per hour (large employers)

- $10 per hour (small employers)

Nassau, Suffolk & Westchester Counties, New York

Effective: December 31, 2017

- 2018 Minimum Wage

- $11 per hour

- $11.75 per hour (fast food workers)

- 2018 Tipped Minimum Wage

- $9.15 per hour (service employees)

- $7.50 per hour (food service employees)

SeaTac, Washington

Effective: January 1, 2018

- 2018 Minimum Wage – $15.64 per hour

- 2017 Minimum Wage – $15.35 per hour

Seattle, Washington

As it stands, Seattle has some of the most complex minimum wage laws in the country. The city is working toward a $15 minimum wage for all of its workers, but to get there, Seattle will be home to no fewer than 7 different minimum wage rates in 2018.

Effective: January 1, 2018

- Small employer – 500 or fewer employees

- Large employers – More than 500 employees

- 2018 Minimum Wage

- $15.45 per hour – large employers (who do not pay toward employee health benefits)

- $15 per hour – large employers (who pay toward employee health benefits)

- $13 per hour – small employers (who do not pay toward employee health benefits)

- $11.50 per hour – small employers (who pay toward employee health benefits)

- 2018 Tipped Minimum Wage

- $14 per hour – small employers who do not pay toward employee health benefits

- $11.50 per hour – small employers who pay toward employee health benefits or for employees who make at least $2.50 per hour in tips

Large employers in Seattle are not allowed to take a tip credit.

Tacoma, Washington

Effective: January 1, 2018

- 2018 Minimum Wage – $12 per hour

- 2017 Minimum Wage – $11.15 per hour

While the Fair Labor Standards Act defines the federal minimum wage and overtime pay regulations, many states have passed their own specific legislation to mandate higher minimums. Some states, on the other hand, haven’t passed any legislation defining a minimum wage. In those places, the Federal minimum, $7.25 per hour, along with overtime regulations, apply. A few states have laws on the books that define minimum wages lower than the federal rate. The federal wage of $7.25 applies in those places, too, since you can’t be lower than the Fair Labor Standards Act’s mandates.

Only American Samoa and the Commonwealth of the Northern Mariana Islands have “special minimum wage rates,” which vary based on industry and are lower than the federal minimum.

Alabama

In Alabama, where no state-specific wage and hour law has been passed, the minimum wage is $7.25.

For nonexempt employees, overtime must be paid for hours worked over 40 in a week, at a rate of one-and-a-half a worker’s regular rate.

To find more information on wage and hour attorneys in Alabama, click here.

Alaska

The 2017 minimum wage in Alaska is $9.80, although licensed school bus drivers are entitled by law to twice that amount ($19.60 per hour in 2017).

In Alaska, overtime wages are also a little different than the federal standard. Hours worked beyond an 8 hour workday, as well as those worked beyond a 40 hour workweek, should be paid at one-and-a-half the employee’s regular rate.

You can learn more about overtime lawyers in Alaska here.

Arizona

Arizona’s minimum wage for 2017 is set at $10 per hour, higher than the federal minimum. Overtime is calculated based on a 40 hour workweek, as it is in the FLSA.

For more on filing an unpaid wage lawsuit in Arizona, follow this link.

Arkansas

Arkansas’ minimum wage is $8.50 for 2017.

Minimum wage and overtime pay requirements in Arkansas only apply to employers with 4 or more employees.

To find details on pursuing your unpaid back wages in Arkansas, visit this page.

California

In California, the 2017 minimum wage is $10 per hour for employers with 25 employees or fewer and $10.50 per hour for employers with 26 employees or more. Many cities in California, along with the County of Los Angeles, have set even higher minimum wages. To learn more about California’s multiple minimum wage requirements, visit our guide to 2017 state minimum wage laws.

The State does not allow employers to take a tip credit, so all tipped workers in California are entitled to the full minimum wage in cash.

Daily & Weekly Overtime

The state’s overtime regulations are complicated. First, overtime wages can apply both to days and weeks, unlike the federal requirements which are only calculated based on a 40 hour workweek.

If you work more than 8 hours in a workday, you are entitled to overtime wages of one-and-a-half your regular rate. Work more than 40 hours in a workweek and those hours should be paid at one-and-a-half, too. In addition, if you’ve worked seven days in a row, the first 8 hours of your seventh day have to be paid as overtime hours.

If you work more than 12 hours in one day, you’re entitled to double your regular rate for any hours over 12. If you work seven days straight, and work more than 8 hours on the seventh day, those extra hours count as double-time.

Find more on getting your stolen wages back on our California overtime lawyers page.

San Francisco

As of May 1, 2015, San Francisco’s minimum wage is $12.25 per hour. But that will continue to increase over the next three years:

- July 1, 2016 – $13.00

- July 1, 2017 – $14.00

- July 1, 2018 – $15.00

Los Angeles

In Los Angeles, the city’s minimum wage will begin to increase in 2016, first to $10.50, and continue to rise until it hits $15 an hour:

- July 2017 – $12

- July 2018 – $13.50

- July 2019 – $14.25

- July 2020 – $15

Oakland

On March 1, 2015, Oakland’s minimum wage became $12.25 an hour.

To learn more about the state wage and hour laws that may entitle California workers to back pay, click here.

Colorado

The 2017 minimum wage in Colorado is set at $9.30.

You can find more information on filing a wage and hour suit in Colorado here.

Commonwealth of the Northern Mariana Islands & Guam

In the Mariana Islands, the minimum wage is $6.05 per hour. While this is lower than the FLSA’s rate, a separate federal law, the Fair Minimum Wage Act of 2007, governs wage regulations for the Islands.

For a quick review of wage laws on the Marianas, click here.

On the island of Guam, $8.25 per hour is the minimum wage. Employees are entitled to overtime pay at the FLSA rate for all hours worked over 40 in a week.

Connecticut

Connecticut’s minimum wage is currently $10.10 per hour. Overtime is calculated on a 40 hour workweek.

For minors working in agriculture or government, the minimum wage is 85% of the regular minimum, around $7.78. For minors in other industries, the minimum wage is 85% for the first 200 hours of work, and then it bumps up to $9.15.

As state law is now written, Connecticut’s minimum wage will never be as low as the federal wage. If the federal minimum is raised in the future, and meets or exceeds Connecticut’s current minimum wage, a law kicks in that automatically raises the wage in Connecticut to 0.5% more than whatever the new federal wage is.

To learn more about pursuing your back wages in Connecticut, follow this link.

Delaware

Delaware’s minimum wage is $8.25. No state law governs overtime regulations, so the FLSA’s protections hold.

Washington, D.C.

Washington, D.C. has the highest minimum wage in the country, at $10.50 per hour. Federal overtime regulations apply for any hours worked over 40 in a week.

If, however, the federal minimum wage is raised to $10.50 or more, D.C.’s minimum automatically becomes $1 higher than the new federal rate.

Florida

Florida’s minimum wage is pegged to a state “consumer price index,” a measure of the cost of living. It’s currently set at $8.10 per hour, but usually changes annually.

FLSA overtime laws apply in Florida: any hours worked over 40 in a week must be paid at one-and-one-half an employee’s regular rate.

To learn more about overtime lawyers in Florida, check out this page.

Georgia

With a minimum wage of $5.15 per hour, Georgia is one of only two states to have a minimum that’s lower than the federal rate.

For employees who are “nonexempt” or covered by the FLSA’s wage provisions, employers in Georgia must pay you at least the federal minimum of $7.25 per hour. But if you’re considered “exempt” from the federal protections, your employer is allowed to pay you as little as $5.15 for an hour’s work.

To learn whether or not you’re covered by the Fair Labor Standards Act, and entitled to a wage of at least $7.25 in Georgia, visit our “Overtime Laws” page. Hopefully, this bill, introduced in Georgia’s Congress on January 13, 2015, will pass: it would raise the state’s minimum wage to $10.10 per hour.

Hawaii

For 2017, the minimum wage in Hawaii is $9.25. On January 1, 2018, the state’s minimum wage will rise to $10.10 per hour.

Overtime is based on a 40 hour workweek. Employees who are guaranteed compensation of $2,000 or more every month are exempt (not covered) by the state’s minimum wage and overtime laws.

Idaho

Idaho’s state minimum wage is $7.25 per hour, same as the FLSA wage. No law in Idaho specifies overtime regulations, so the federal standards hold: any hour worked over 40 in a week has to be paid at one-and-a-half a worker’s regular rate.

Illinois

As of February 24, 2015, Illinois’ minimum wage is $8.25 per hour. This is higher than the federal minimum wage. Employees covered by the FLSA are entitled to Illinois’ higher hourly wage.

For the purposes of overtime wages, Illinois’ state laws follow the FLSA closely. Workers covered by the law’s protections are entitled to wages of one-and-a-half their regular rate for all hours worked over 40 in a workweek.

Chicago

For most employees in Chicago, the city’s current minimum wage is $10. That will change dramatically over the next few years:

Indiana

The minimum wage in Indiana is $7.25, the same minimum mandated by federal law. Overtime is based on a 40 hour workweek, and must be paid at one-and-a-half a worker’s regular rate.

Indiana’s minimum wage regulations apply to employers with 2 or more employees.

Iowa

Iowa’s current minimum wage is $7.25, the FLSA minimum, but if the federal minimum is raised in the future, Iowa’s will be automatically raised to meet it.

Employers in Iowa are allowed to pay a “training wage” of $6.35 per hour for the first 90 calendar, not work, days of employment.

Overtime in Iowa is governed by the Fair Labor Standards Act and must be paid at one-and-a-half a worker’s regular rate for all hours worked over 40 in a week.

Kansas

Kansas’ minimum wage is $7.25.

Any employee in Kansas who is covered by the Fair Labor Standards Act is exempt from the state’s specific wage and hour laws. For workers who are not covered by the FLSA, overtime must be paid at at least one-and-a-half an employee’s regular rate for any hours worked over 46 in a workweek. Workers who are covered by the FLSA are entitled to overtime pay after 40 hours in a week.

To learn if you’re eligible for the Fair Labor Standards Act’s protections, click here.

Kentucky

Kentucky’s minimum wage is $7.25. Overtime must be paid for any hours worked over 40 in a week, at a wage one-and-a-half times a worker’s regular rate.

Kentucky has a “7th day overtime” law: if you work seven days straight in one workweek, all of your hours on the seventh day must be paid at your overtime wage.

Learn more about Kentucky’s state labor laws that protect workers here.

Louisiana

Louisiana doesn’t have any state wage or overtime laws, so the state’s nonexempt employees are governed by the Fair Labor Standards.

If you are covered by the FLSA, your minimum wage is $7.25 and you are entitled to overtime at a rate of one-and-a-half your regular rate for all hours worked over 40.

Maine

Maine’s minimum wage is currently $9 per hour. In Portland, the State’s most populous city, the local minimum wage has been set at $10.68 for 2017.

If the federal minimum wage increases in the future, Maine’s state minimum will increase, too, but no more than $1 per hour over the previous state wage.

For example, if the federal minimum wage was raised to $8.75 tomorrow, Maine’s minimum wage would only rise to $8.50. But all employees covered by the (now amended) FLSA would still be entitled to a minimum of $8.75 per hour. Only FLSA-exempt employees would be subject to the Maine-specific $8.50.

Maryland

The 2017 minimum wage in Maryland is $9.25. Overtime is calculated on a 40 hour workweek. Several counties, including Prince George’s County and Montgomery County, will increase their own minimum wages to $11.50 per hour in 2017. Prince George’s County’s rate increase is set to take effect on October 1, 2017. Montgomery County will change its minimum wage on July 1, 2017.

Maryland’s minimum is automatically raised to meet changes in the federal wage.

Massachusetts

In Massachusetts, the minimum wage is $11 per hour. Overtime is paid for all hours worked over 40 in a workweek, but retail workers in the state are also entitled to time-and-a-half for hours worked on Sundays.

By law, Massachusetts’ minimum wage must always be at least $0.50 more than the federal minimum wage.

Michigan

Michigan’s 2017 minimum wage is $8.90 per hour. Overtime is paid for hours worked over 40 in a week.

Minnesota

For small employers, businesses making annual revenue less than $500,000, Minnesota’s minimum wage is the same as the federal wage: $7.25 per hour. For employers making $500,000 or more, the minimum wage is $9.00.

In both cases, employees who are exempt from the FLSA are entitled to overtime (at one-and-a-half their regular rate) for any hours worked over 48 in a workweek.

To find out how much compensation you’re entitled to by state law, check out our guide on Minnesota’s wage and hour protections. Our attorneys regularly work on behalf of employees in Minnesota. To learn more about the team, follow this link.

Mississippi

With no state minimum wage or overtime laws, nonexempt employees in Mississippi are entitled to the federal minimum of $7.25 per hour and overtime wages for any hours worked over 40 in a week, at one-and-a-half times the worker’s regular rate.

Missouri

Missouri’s minimum wage is currently $7.70, but usually changes every year based on the cost of living in state. Overtime must be paid for hours worked over 40 in a week.

For workers employed by seasonal amusement or recreation businesses, overtime must only be paid for hours worked over 52 in a workweek.

Montana

Montana’s minimum wage for 2017 is $8.15. Most workers are entitled to overtime wages for any hours worked over 40 in a week.

If you work for a business that isn’t covered by the FLSA, and your employer has annual sales of $110,000 or less, your wage can be as low as $4.00 per hour in Montana. If, on the other hand, part of your job requires you to move goods between states, you must be paid Montana’s minimum of $8.05.

Nebraska

Nebraska’s minimum wage is $9.00 per hour, unless you work for a business who employs less than 4 employees.

Since no state law specifies requirements for overtime pay, Nebraskan employers are governed by the FLSA and must pay eligible employees overtime for all hours worked over 40 in a workweek at one-and-one-half times their regular rate.

Nevada

Nevada’s state minimum wage may change depending on whether or not you get health insurance through your employer.

- If your employer provides health insurance benefits, then your minimum wage is $7.25 (same as the federal minimum wage).

- If your employer doesn’t provide health insurance, your minimum wage is $8.25.

Overtime pay kicks in for any hours worked over 40 in a week, and also for hours worked over 8 in a day.

Overtime wages must be paid at one-and-one-half your regular rate, unless you make at least one-and-one-half the minimum wage normally or you work for a smaller company that grosses less than $250,000. In either of those situations, you probably aren’t entitled to overtime pay at all.

New Hampshire

New Hampshire has its own wage and hour laws on the books, but they’re no different than the FLSA. The minimum wage is $7.25 per hour, and overtime is paid for any hours worked beyond 40 in a week, at one-and-one-half a worker’s regular rate.

New Jersey

The minimum wage in New Jersey is currently $8.44 per hour, but usually changes annually based on the cost of living in-state.

For eligible employees, overtime wages must be paid at one-and-one-half the employee’s regular rate for all hours worked over 40 in any one workweek.

New Mexico

In New Mexico, the minimum wage is $7.50. Overtime is calculated on a 40-hour workweek basis, and must be paid to covered employees at one-and-one-half their regular rate.

New York

In 2017, New York is home to over a dozen minimum wages. To learn which legally-required rate applies in your case, check out our complete guide to New York’s 2017 minimum wages by clicking here.

Many employees are governed by New York’s “one day rest in seven” law, including:

- factory workers,

- employees in retail establishments, hotels and restaurants,

- elevator operators,

- actors, stage-hands and all other employees working on “legitimate theatre productions,”

- apartment, office building, garage and storage facility watchmen, engineers and firemen

- most janitors, superintendents, supervisors and managers in apartment or office buildings

These workers are entitled to 24 consecutive hours off in every calendar week. Employees who work on this seventh day are entitled to overtime wages.

For “residential” workers, who live in their employers’ homes, overtime must be paid after 44 hours of work in any given week.

Employees in New York who work for more than 10 consecutive hours at a time, or have a split shift, are entitled to 1 hour’s pay at the state minimum wage, in addition to their earned wages for the applicable time period.

For more information on our team of New York overtime attorneys, click here.

North Carolina

The minimum wage in North Carolina is $7.25. Overtime wages, at one-and-one-half an employee’s regular rate, are due for hours worked over 40 in a workweek.

Employees of seasonal recreation or amusement businesses are entitled to overtime for hours worked over 45 in a workweek.

North Dakota

North Dakota’s minimum wage is $7.25. Most employees are entitled to overtime for any hours worked over 40 in one workweek.

Ohio

In Ohio, the minimum wage depends on how much your employer’s business makes each year.

Businesses making:

- $297,000 or more in annual gross receipts must pay at least $8.15 per hour

- less than $297,000 in gross receipts must pay at least $7.25 per hour

In both cases, most workers will be entitled to overtime wages for any hours worked over 40 in a workweek.

Oklahoma

In Oklahoma, employers with ten or more full-time workers at any one location or employers with annual gross sales more than $100,000 (no matter how many employees they have) are covered by the FLSA. Thus their employers are entitled to a minimum wage of at least $7.25 per hour and overtime wages for hours worked over 40.

But for all other employees, and those who are not covered by the FLSA explicitly, Oklahoma’s state minimum wage applies: $2.00 per hour.

Oregon

Oregon’s minimum wage is $10.25 per hour, and most employees are entitled to overtime for hours worked over 40 in a week. In the Portland-metro area, however, the minimum wage is actually higher, set for 2017 at $11.25 per hour. In “nonurban counties,” on the other hand, the minimum wage is lower, currently $10. To find out what Oregon considers a “nonurban county,” click here.

For some employees, Oregon also applies a daily overtime pay requirement. Employees in nonfarm canneries, packing plants, driers, mills, factories or manufacturing plants are entitled to overtime for hours worked over 10 in a 24-hour consecutive period.

Workers at sawmills, shingle mills, planning mills and logging camps are not covered by this daily overtime regulation.

Pennsylvania

Pennsylvania’s minimum wage is $7.25 per hour. Most workers are entitled to overtime for hours worked beyond 40 in a week.

For more information on our attorneys serving workers in Pennsylvania, visit this page.

Puerto Rico

In Puerto Rico, businesses that are covered under the Fair Labor Standards Act’s provisions are governed by the Act’s Wage and Hour requirements. For these employers, an hourly minimum wage of $7.25 is mandated.

For employers who aren’t covered by the FLSA, Puerto Rico has a “mandatory decree rate” of $5.08 per hour. People who work for businesses that aren’t covered by the FLSA are entitled to 70% of the current federal minimum wage or the mandatory decree rate ($5.08), whichever is higher. Right now, it’s the mandatory decree rate of $5.08 per hour.

For nonexempt employees, overtime is required for any hours worked over 40 in a work-week, at the FLSA rate of one-and-one-half the worker’s regular rate. Workers covered by the FLSA are also entitled to overtime wages for hours worked over 8 in a workday.

But for workers who aren’t covered by the FLSA, Puerto Rico’s overtime requirements are actually higher. For these employees, overtime is paid as double time, twice an employee’s regular rate. Double time wages are also mandated for hours worked over 8 in a workday, as well as any hours worked on an employee’s “day of rest.” If an employee works seven days in a row, their wages are doubled for the seventh day.

Rhode Island

Rhode Island’s minimum wage is $9.60, and most workers are entitled to overtime wages for hours worked beyond 40 in a workweek.

For some employees in state, including those working in retail, two additional laws mandate time-and-a-half wages for any work on Sundays or holidays.

South Carolina

South Carolina doesn’t have any state-specific wage and hour laws, so covered employers are governed by the FLSA’s requirements. For most workers, a minimum wage of $7.25 per hour and overtime wages of time and a half for all hours worked over 40 in a week will apply.

To learn whether or not you’re eligible for the Fair Labor Standards Act’s protections, click here.

South Dakota

South Dakota’s minimum wage is $8.65 per hour. While no specific state laws provide for overtime wages, employees in the state who are covered by the FLSA are entitled to time-and-a-half for hours worked over 40 in a workweek.

Tennessee

Tennessee has no wage and hour legislation, so only employees covered by the Fair Labor Standards Act are guaranteed a minimum wage of $7.25 and overtime at one-and-a-half their regular rate.

Texas

By state law, Texas’ minimum wage is always the same as the federal minimum. Currently, that’s $7.25 per hour.

Employees eligible for the FLSA’s protections are entitled to overtime wages of time and a half for hours worked beyond 40 in any given workweek.

For more on filing an unpaid overtime lawsuit in Texas, click this link.

Utah

Utah’s minimum wage is $7.25. Without state-specific overtime laws, only employees in Utah who are covered by the FLSA are entitled to wages one-and-a-half their regular rate for any hours worked over 40 in a week.

Vermont

Vermont’s 2017 minimum wage is $10 per hour. For all employees covered by the FLSA, overtime wages are mandated at one-and-a-half a worker’s regular rate for hours worked over 40 in a week.

Some Vermont workers who are not eligible for the FLSA’s overtime protections will be covered by a Vermont-specific overtime law that mandates the same things: time and a half for hours worked over 40.

But there are numerous exemptions to this provision, including:

- retail and service establishment employees

- seasonal amusement and recreation employees

- hotel, motel and restaurant workers

- transportation employees (who aren’t covered by the FLSA)

US Virgin Islands

In the Virgin Islands, most employees are entitled to a minimum wage of $7.25. Overtime is mandated for any hours worked over 8 in a day, or 40 in a week. Employees who work 6 or 7 days in a row are entitled to overtime wages for any of those hours.

Employers who make less than $150,000 in gross receipts are allowed to pay their workers as low as $4.30 per hour. These workers are exempt from the Islands’ overtime requirements, too.

Virginia

Virginia’s minimum wage is $7.25. Employees covered by the FLSA are entitled to overtime at one-and-a-half their regular rate for all hours worked beyond 40 in a workweek.

Washington

In Washington, the minimum wage for 2017 is $11.

Most workers are entitled to overtime pay after working a base 40 hours in one workweek. For hours over 40, the majority of employees are entitled to time and a half.

Seattle

As of January 1, 2016, Seattle’s minimum wage is $13 per hour. It will increase over the next few years until it reaches $15.

West Virginia

For employers with 6 or more employees at any one location, West Virginia’s minimum wage is $8.75, and most of these workers will also be eligible for overtime wages of time and a half after working 40 hours in a workweek.

Wisconsin

Wisconsin’s minimum wage is $7.25. Most workers will be entitled to overtime wages for any hours worked beyond 40 in a given week.

Wyoming

In Wyoming, the minimum wage is set at $5.15, lower than the federal minimum of $7.25 per hour. For almost all employees, the federal minimum wage will hold, so the majority of workers are entitled to at least $7.25.

Most Wyoming low-wage workers will also be entitled to the FLSA’s overtime protections: time and a half for hours worked over 40 in a week.

Very Helpful! Wage Advocates were easy to work with and extremely informative. I understood what was happening each step of the way."Rating: 5.0 ★★★★★