New York Minimum Wage Increases For 2017

Last year, New York Governor Andrew Cuomo announced an ambitious goal: by 2021, the State’s minimum wage will reach $15 per hour. Over the next five years, New York’s minimum wage will increase annually, the New York Times reports, in a strategy that should allow businesses more time to adjust to a significant rise in labor costs.

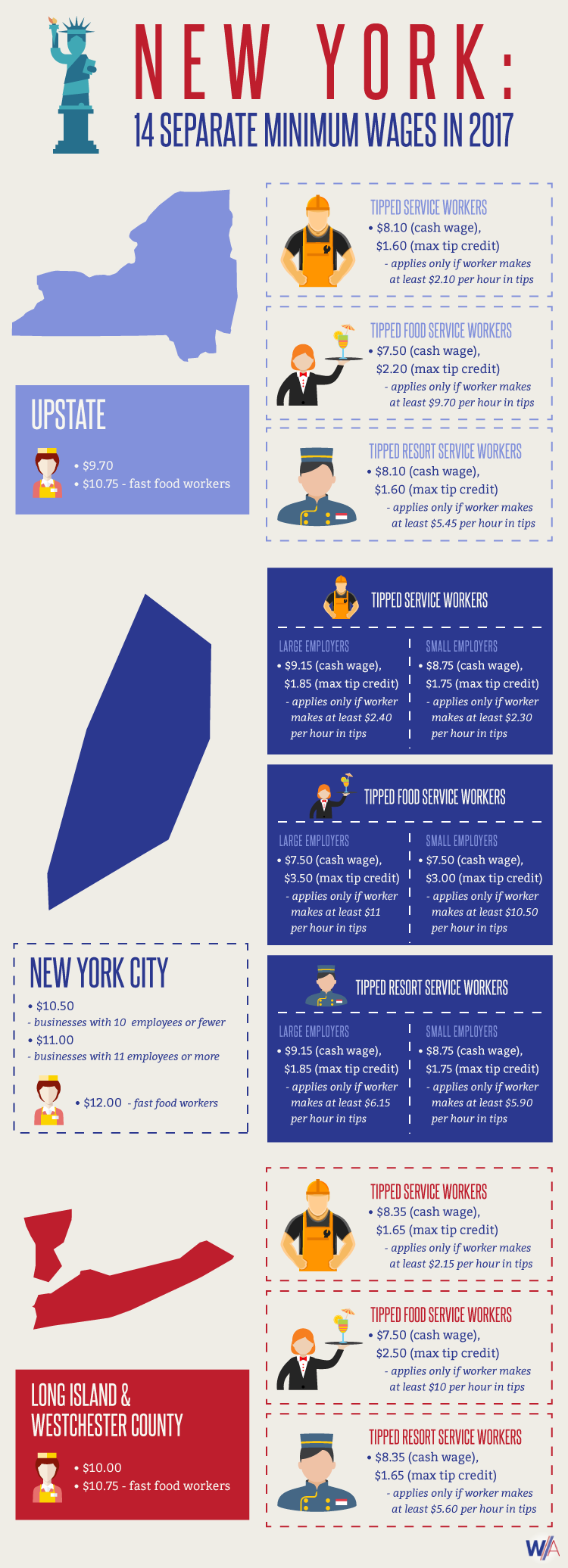

Cuomo’s plan, however, is extremely nuanced. Instead of increasing New York’s minimum wage across-the-board, the State’s legislature has decided to stagger wage hikes, taking regional variations and employer size into account. That means different workers will be entitled to different minimum wages, at least until 2021.

What Is The Minimum Wage In New York?

While few employees would criticize an increase in pay, the State’s new patchwork of labor regulations has caused a lot of confusion. In 2017, 14 different minimum wages will be active in New York. Not sure which law applies to you? Our infographic might help:

Want to share our New York minimum wage infographic on your own site? Just copy and paste the code below:

Let’s start with New York City, where workers can expect the biggest raises in 2017.

Minimum Wages In New York City (2017)

Fast food workers in NYC are currently entitled to the State’s highest minimum wage: $12 per hour. To find out which businesses New York considers “fast food,” click here. Outside of the fast food industry, employees are split up by their employer’s size. Workers at large businesses, which have 11 employees or more, are entitled to at least $11 per hour. At small businesses, with 10 employees or fewer, employees are entitled to $10.50 per hour.

| Worker Type | Business Size | 2017 Minimum Wage |

|---|---|---|

| Fast Food Workers | N/A | $12 |

| N/A | Large Employers | $11 |

| N/A | Small Employers | $10.50 |

Tipped Workers In New York City

Next, we’ll cover tipped workers. New York divides tipped workers into three different industries:

- tipped food service workers – any employee primarily engaged in the serving of food or beverages, who also regularly receives tips (wait staff, bartenders, bussers)

- tipped service workers – any employee, other than a food service worker, who regularly receives tips

- tipped resort service workers – any service employee (as opposed to a food service employee) who works at a resort hotel

New York law allows most employers to take a “tip credit” in paying their tipped employees. In essence, the majority of employers will be able to pay tipped workers less than minimum wage, as long as an employee’s average tips per hour make up the difference. In the following discussion of New York’s new minimum wage laws, we’ll provide you with two different numbers:

- cash wage – the least an employer can pay in direct hourly wages to a tipped worker

- tip credit – the most an employer can legally deduct from an employee’s cash wage due to their tips

In every case, adding these two numbers together should equal the state minimum wage that a worker would be entitled to, if they did not receive any tips. Here’s an example. In New York City, food service workers at large employers are now entitled to a minimum wage of $11. But when tips are factored in, a large employer can pay food service workers a minimum cash wage of $9.15 per hour. In other words, the employer is allowed to take a maximum tip credit of $1.85 per hour worked.

There are, however, some additional conditions described in state law. Where tipped food service workers in NYC are concerned, large employers can only take a tip credit if the worker makes at least $2.30 per hour in tips. If a worker’s hourly tips fall below that mark, the employer must pay the worker the full minimum wage in cash.

| Worker Type | Employer Size | Cash Wage | Tip Credit | Hourly Wage Total | Conditions |

|---|---|---|---|---|---|

| Service Worker | Large Employer | $9.15 | $1.85 | $11 | at least $2.40 per hour in tips |

| Service Worker | Small Employer | $8.75 | $1.75 | $10.50 | at least $2.30 per hour in tips |

| Food Service | Large Employer | $7.50 | $3.50 | $11 | hourly wage must equal at least $11 |

| Food Service | Small Employer | $7.50 | $3.00 | $10.50 | hourly wage must equal at least $10.50 |

| Service Worker | Small Resort Hotel | $8.75 | $1.75 | $10.50 | at least $5.90 per hour in tips |

| Service Worker | Large Resort Hotel | $9.15 | $1.85 | $11 | at least $6.15 per hour in tips |

Please note that New York does not allow employers in the fast food industry to take a tip credit.

Long Island & Westchester County

Employees working in suburbs of New York City, namely Long Island and Westchester County, are entitled to one of two minimum wages, depending on their job duties:

- $10.75 per hour – fast food workers

- $10 per hour – all other workers

As in New York City, tipped workers in Long Island or Westchester County are treated based on their industry, but this time, the size of an employer no longer matters:

| Worker Type | Cash Wage | Tip Credit | Hourly Wage Total | Conditions |

|---|---|---|---|---|

| Service Worker | $8.35 | $1.65 | $10 | at least $2.15 per hour in tips |

| Food Service Worker | $7.50 | $2.50 | $10 | hourly wage must equal at least $10 |

| Resort Service Worker | $8.35 | $1.65 | $10 | at least $5.60 per hour in tips |

Upstate New York

Workers across New York can expect to make $15 per hour by 2021, but their wages won’t be reaching that mark as quickly as employees in New York City or its suburbs. In 2017, workers upstate are entitled to:

- $10.75 per hour – fast food workers

- $9.70 per hour – all other workers

Tipped workers are divided into three separate categories: general service employees, food service employees and service workers at resort hotels.

| Worker Type | Cash Wage | Tip Credit | Hourly Wage Total | Conditions |

|---|---|---|---|---|

| Service Worker | $8.10 | $1.60 | $9.70 | at least $2.10 per hour in tips |

| Food Service Worker | $7.50 | $2.20 | $9.70 | hourly wage must equal at least $9.70 |

| Resort Service Worker | $8.10 | $1.60 | $9.70 | at least $5.45 per hour in tips |

What Is A Fast Food Worker?

The New York Department of Labor has provided a detailed description of which employers should be considered “fast food establishments” under State law. As state officials outline, a fast food establishment fulfills the following three criteria:

- primarily serves food or drinks (including coffee shops, juice bars, donut shops and ice cream parlors)

- offers limited service, where customers order and pay before eating, including restaurants with tables but without full table service, and businesses that provide only take-out service

- is part of a chain of 30 or more locations, including individually-owned establishments associated with a brand that has 30 or more locations nationally

As we can see, New York is clearly targeting many national franchise operations for minimum wage hikes, but also leaving room for the State’s larger regional players. Here are some key examples, as provided by New York’s Labor Department:

- McDonald’s

- KFC

- Wendy’s

- White Castle

- Ben & Jerry’s

- Taco Bell

- Chipotle

- Shake Shack

- Jamba Juice

- Dunkin Donuts

- Starbucks

- Tim Hortons

- Nathan’s Famous

- Quiznos

- Subway

- Pizza Hut

- Uno Pizzeria & Grill

- Golden Krust Caribbean Bakery & Grill

What Is A Resort Hotel In New York?

New York’s Department of Labor defines a resort hotel as any hotel “that offers lodging accommodations to the public or to members or guests of members, and meets [either] of the following two requirements:

- the hotel operates for not more than seven months in any calendar year

- the hotel is in a rural community or in a city or village of less than 15,000 population and the hotel increases its number of employee work days or guest days during any consecutive four-week period by at least 100 percent over the number of days in any other consecutive four-week period within the preceding calendar year”

Seasonal vacation destinations are the main target of this definition, including many establishments throughout the Catskills.