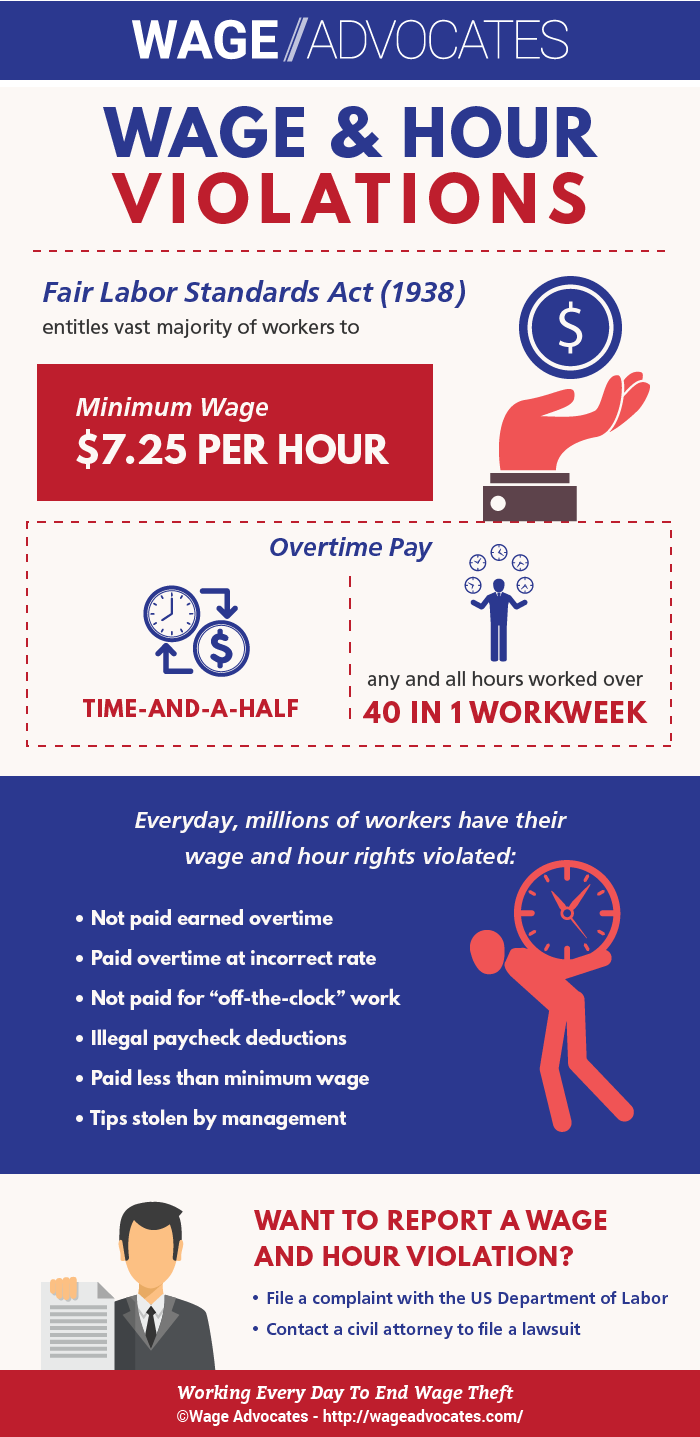

When an employer breaks one of the minimum wage or overtime pay laws established in the Fair Labor Standards Act (FLSA), they have committed a “wage and hour violation.”

A Complete Guide To Wage & Overtime Violations

Under federal laws set forth in the FLSA, most American workers are entitled to a minimum wage of $7.25 per hour and so-called “premium,” or overtime, wages for any hours worked over 40 in a week. The FLSA also outlines what counts as “work” and how employers have to count work hours, requirements that become critical in calculating overtime wages. By violating any one of these laws, an employer has committed a wage and hour violation.

Want to share our infographic on your own site? Just copy and paste the code below:

Which Violations Are The Most Common?

This question is harder to answer than you’d think.

While the Department of Labor (DOL) collects about $250 million in back wages for American workers every year, their statistics aren’t very detailed.

For many years, the DOL reported more violations of minimum wage requirements than overtime violations. 2014 was the first year in which this equation flipped: the DOL reported 11,238 cases of overtime violations and 11,042 for minimum wage infringements.

But it’s always been true that employers steal more, much more, through overtime violations than minimum wage ones. In 2014, almost 80% of all the back wages collected by the DOL were related to overtime wage infractions.

Beyond these two rough categories, we have to turn to other sources to get a picture of wage and hour violations on the ground.

6 Most Common Wage And Hour Violations

The most comprehensive study on real-world wage and hour violations was completed in 2008 by the National Employment Law Project.

They surveyed thousands of low-wage workers in three major US cities, and asked:

- how much did you work last week?

- how much did you make last week?

Then they figured out how much the workers should have made, if every federal and state wage and hour law had been followed appropriately. Here’s what they ranked as the most common violations:

1. Not Paying Overtime Correctly

76% of the workers who worked more than 40 hours in a week weren’t paid overtime or were paid overtime at an incorrect rate.

Under the FLSA, the majority of employees are entitled to “time-and-a-half” for any hours worked over 40 in a given week. For these additional hours, workers must be paid at one-and-a-half their “regular rate,” which may also include bonuses and commissions they make during that week.

Learn how to calculate your correct regular rate here.

2. Failing To Pay For “Off-The-Clock” Work

70% of employees didn’t get paid for the work they performed outside of their regular shift.

If your employer allows you to perform work, and they can expect to benefit from your labor, those hours have to be counted towards your wages and overtime. Pre- or post-shift; it doesn’t matter.

Click here to learn how the FLSA defines “work” and how that specific definition affects the overtime wages you’re entitled to.

3. Making Illegal Deductions From A Paycheck

41% of workers had illegal deductions taken from their paychecks.

Some employers bought uniforms, tools or other supplies, and then deducted the cost of those business items from their worker’s wages. That’s not illegal, unless the deductions make your wage lower than the minimum wage. In that case, it’s a wage and hour violation.

For workers who only make the minimum wage, employers aren’t allowed to deduct anything. That goes for uniforms, drawer shortages and damaged equipment, too.

For tipped employees, however, employers are allowed to pay lower than the minimum wage.

4. Paying Tipped Employees Lower Than Minimum Wage

30% of tipped workers weren’t paid the tipped minimum wage.

Under the FLSA, employers are allowed to pay workers who regularly receive more than $30 in tips every month lower than the federal minimum wage. But there’s a strict limit: the lowest cash wage an employer can pay a tipped employee is $2.13 per hour.

Many states have adopted their own maximum “tip credits,” the most an employer can deduct from their minimum wage obligations before violating the law. To learn more about state-established tip credits, visit our new 2017 guide to state minimum wages here.

5. Paying Less Than Minimum Wage

It’s hard to believe that the most basic worker protection in America is violated at all, but a full 26% of the workers polled were paid less than minimum wage. That’s an insult.

Under federal law, most workers are entitled to at least $7.25 per hour. To find out if your state minimum is different, click here.

6. Stealing Tips

12% of tipped workers had their tips stolen by their employer.

You have every right to your tips. You’ve earned that money through your hard work, and no one should be able to take it away from you.

There is, however, a notable exception that the FLSA considers valid in some cases: tip pooling.

In a tip pool, employees chip in a certain amount of their tips and then the pool is divided equally among them. If your employer takes a “tip credit,” reducing your hourly wage below the minimum, you can only be required to chip in tips that are in excess of the tip credit.

So if your employer plans to take the maximum tip credit of $5.12 for one hour, and you make $8.00 in tips that hour, the most you’re required to chip in is $2.88, or $8.00 minus $5.12.

Only workers who regularly receive tips are allowed to chip in and benefit from the pool. Employers are never allowed to take money from the tip pool.

Where Are Wage & Hour Violations Most Common?

Three industries stood out as main violators:

- Apparel and textile manufacturing

42.6% of workers in apparel and textile manufactured were the victims of minimum wage violations

- Personal services, like workers at car washes and hair salons

92% of personal service workers were the victims of overtime violations. The study found the same rate of violation for workers in repair-related jobs.

- Private households

41.5% of domestic workers were the victims of minimum wage violations. Upwards of 66% of child care workers were illegally paid less than minimum wage.

In restaurants, warehouses, supermarkets and other retail businesses, between 20% and 25% of workers were the victims of wage and hour violations, most notably minimum wage violations.

Around 13% of employees in construction, education and home health care experienced violations.

What If State Wage & Hour Laws Are Different?

Some states have established their own laws. When these state regulations are more “generous” to working individuals and families, federal law says the state wage and hour laws take precedence over the federal ones.

For example, California’s minimum wage is currently $12 an hour at large employers and $10.50 at smaller employers, considerably more “generous” than the federal minimum wage. Covered employers in California are required, by state and federal law, to pay their nonexempt employees this higher minimum wage.

If they don’t, even if they pay workers $7.25 per hour, they’re committing a wage and hour violation according to both state and federal law.

Many states also have more “generous” overtime regulations. According to the FLSA, employers are required to calculate overtime pay based on a 40 hour workweek. Federal law doesn’t take how many hours you work in one day into account.

But California does. In the state, nonexempt workers are entitled to “time-and-a-half” wages for all hours worked over 8 in a day. Since this law is obviously more generous than the federal regulations, the FLSA defers to the state’s requirements.

In short, an employer can be held liable for violating state wage and hour laws, even if they’ve followed federal law to the letter.

To find out whether your state has its own minimum wage, visit “Overtime & Minimum Wage Laws: State By State.”

What If I’m The Victim Of A Wage And Hour Violation?

Think you’re not being paid what you’ve earned? The FLSA gives you two options:

- report a possible wage and hour violation to the Department of Labor

- file a civil lawsuit against your employer

In either case, you may be entitled to double wages. You can recover both the wages you lost because of your employer’s illegal activity and an equal amount called “liquidated damages.” Most civil lawsuits also seek damages to cover attorney fees and court costs.

Thank you! It was such a relief to know that Wage Advocates were working hard to get me compensation for my unpaid overtime."Rating: 5.0 ★★★★★