For most workers in the US, overtime pay is mandatory.

The Fair Labor Standards Act requires that covered employers pay their nonexempt employees “premium” wages for all hours worked over 40 in a week. That means overtime.

Am I Entitled To Overtime Pay?

In this guide, you’ll find out if your employer is considered a “covered” employer. Only covered employers are required to pay their employees overtime. However, some employees, even ones working for covered employers, aren’t entitled to overtime. These workers, who don’t need to be paid overtime wages, are considered “exempt” from the Fair Labor Standards Act’s federal labor law requirements. While exempt employees usually aren’t entitled to the FLSA’s minimum wage provisions, either, most are already making more than that.

In short, if you:

- work for an employer who is covered by the FLSA, and

- you are considered “nonexempt” under the law

overtime pay is mandatory. You have a legal right to premium wages. Overtime must be paid at “time-and-a-half”: one-and-a-half times your “regular rate.” Learn how to calculate your own regular rate here.

1. Is My Employer Covered?

The FLSA’s overtime requirements apply to employers who either:

- make $500,000 or more in annual sales, or

- engage in interstate commerce.

This kind of makes it sound like only big companies are covered, but that’s not true at all. US courts take a very broad interpretation of “interstate commerce,” which is essentially conducting business between states. That’s not just shipping goods over state lines. Using a company phone or computer to call or send emails between states is often enough to make an employer covered under the FLSA. So is sending letters or invoices to other states through the US mail.

The FLSA also describes certain specific employers who are covered, regardless of their annual sales or engagement in commerce between states:

- Hospitals

- Residential medical or nursing facilities

- Schools, including preschools

- Government agencies

Some businesses, like small farming operations, are explicitly left out of the Act’s protections. But in practice, only a small minority of employers won’t be covered by the FLSA.

2. Is My Job Exempt From Overtime?

While specific jobs are explicitly exempt under the FLSA, most employers take advantage of three broad categories of workers who may be exempt. These are sometimes called “white collar exemptions.”

Do You Make A Salary?

Exempt workers get paid a salary.

Salaries can’t change based on how many hours you work in a week; if they did, you’d be an hourly employee.

Common Wage Violation:

Treating Salaried Workers Like Hourly Workers

Some employers try to have it both ways, categorizing salaried employees as “exempt” but docking their pay for late arrivals. But that would be treating an employee on a salary like an hourly worker, and it’s illegal under the FLSA.

If you make a salary but have your paycheck reduced because of tardiness or infrequent errands, you may not actually be exempt under the FLSA. That means you’re probably owed back wages.

The FLSA was designed to protect workers paid on an hourly basis. If you get paid an hourly wage, you can stop reading right now. You’re entitled to overtime. But even if you make a salary, you may still be entitled to overtime.

There’s a salary threshold, a level set by the federal government. Make more than the salary threshold and you may not be entitled to overtime. Make less than the salary threshold and you’re definitely entitled to overtime.

So what is the salary threshold?

How Much Do You Make?

That’s a funny question, because the salary threshold is about to change. Right now, the salary threshold is set at $455 per week, or $23,660 per year. If you make less than that, or get paid an hourly wage, you can stop reading right now. You’re entitled to overtime. But this number is going to rise very soon.

On December 1, 2016, the Labor Department will raise the federal salary threshold to $913 per week, or $47,476 per year. After December 1, every salaried worker making less than $47,476 per year will be automatically entitled to overtime wages.

But we’re still not done. Some workers who make a salary of $455 per week (or $913 per week as of December 1, 2016) are still entitled to overtime. Why? Because the government cares more about what you do at work, than how much you get paid.

What Work Do You Do?

The FLSA outlines three categories of workers who may be exempt: executives, administrators and professionals. If you can’t be classified as an executive, administrator or professional, overtime pay is almost certainly mandatory.

Here’s a short description of the “exempt” categories:

- Executives – supervise two or more other employees, and management is defined as the primary duty of their employment. Executives also have some real input in personnel decisions. That doesn’t necessarily mean that executives actually hire and fire people, but their involved in the decision-making process.

- Administrators – do “nonmanual” work, like traditional office work, but they don’t just follow a company rule book. Administrators have to use their own “independent judgement” to make real decisions that impact significant aspects of a business’ operations or management.

- Professionals – perform what’s usually considered “intellectual” labor, using independent judgement to complete work that requires advanced knowledge in their particular field. Normally, administrators have an advanced degree, like a Masters, to represent their “advanced knowledge.”

These categories aren’t cut-and-dried. You might feel like an exempt employee, but actually be nonexempt. Or you might feel like a nonexempt employee, but actually be exempt. So how do you know for sure? Ultimately, it’s a question for the Labor Department or court system to answer.

Judges and federal investigators look at each employee individually, gauging their job duties against the federal law’s requirements, and make determinations on a worker-to-worker basis. Of course, there are some workers who are obviously “nonexempt.” In fact, the vast majority of American employees are “nonexempt,” and thus entitled to overtime.

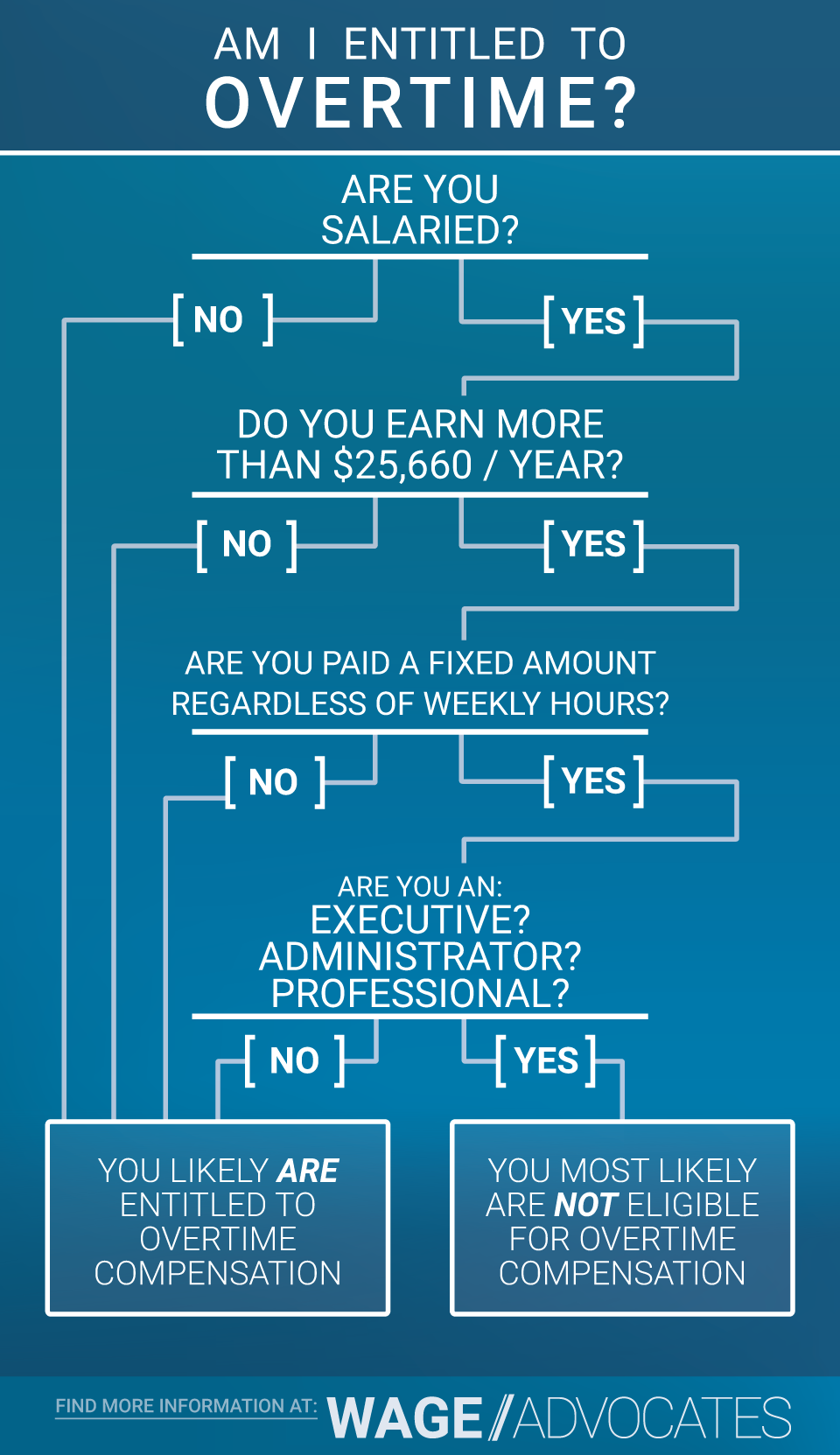

Confused? This Could Help.

Here’s a flow chart to help you figure out whether you’re considered “exempt” under the FLSA:

Do Employers Have To Pay Overtime?

Yes. Most employers have to pay overtime wages, at least to some of their workers. Again, it’s a case-by-case determination. But covered employers are required to pay their nonexempt workers overtime, when those workers do more than 40 hours of work in a workweek. There’s no legal way out of this requirement; it’s absolutely mandatory.

Very Helpful! Wage Advocates were easy to work with and extremely informative. I understood what was happening each step of the way."Rating: 5.0 ★★★★★