America has one of the most developed healthcare systems in the world. But the country, as we’re told, again and again, is facing a serious shortage of doctors. So where does our relative health superiority come from?

The answer is clear: while there are only an estimated 729,000 doctors currently practicing in the US, our nation is home to almost 4 million working nurses.

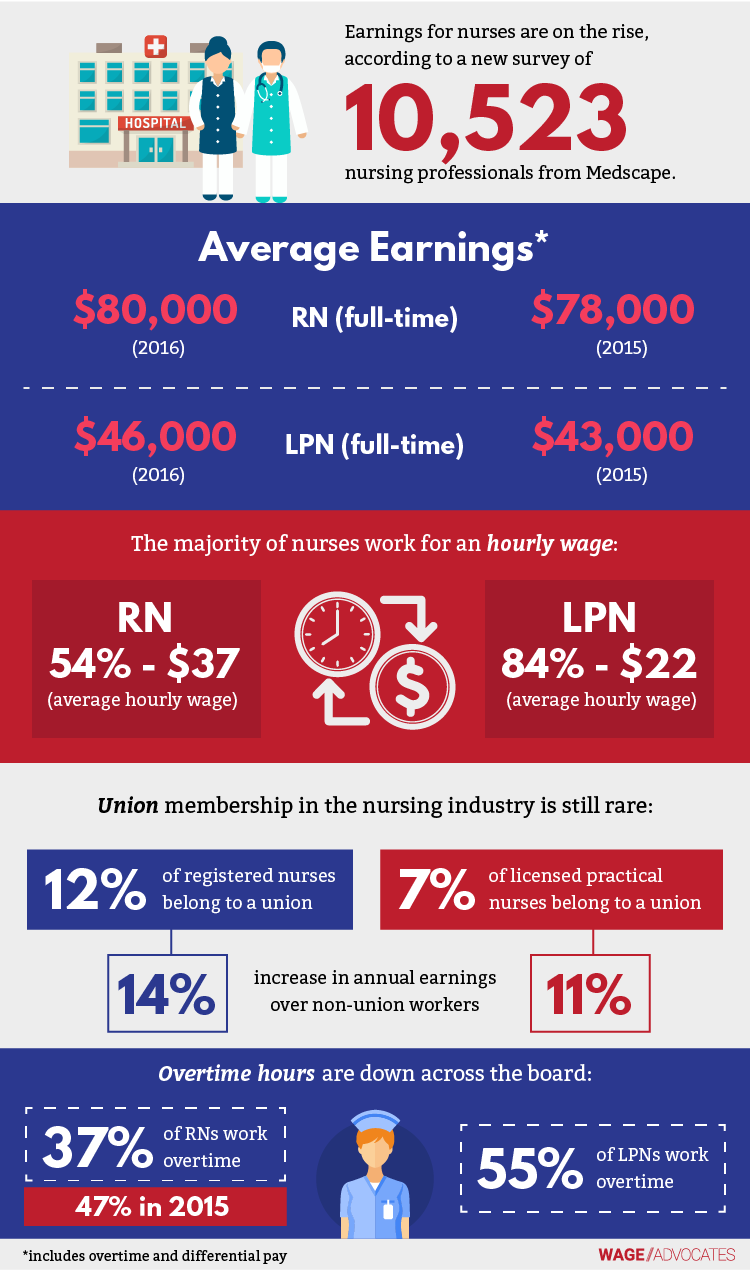

Hourly Nurses: Common Victims Of Wage Theft

RNs and LPNs are the backbone, muscles, vital organs and glands of the American health system. So why are so many hourly nurses being cheated out of the wages they’ve rightfully earned?

The vast majority of hospitals, nursing homes, and health clinics are covered employers under the Fair Labor Standards Act. Any institution that is “primarily engaged in the care of the sick, the aged, or the mentally ill” is bound to employ some workers who are entitled to overtime wages.

Similarly, the majority of hourly nurses are entitled to a minimum wage of $7.25 per hour and overtime wages (at one-and-a-half their regular rate) for any hours worked over 40 in a given week.

But thousands of nurses every year aren’t getting their due compensation.

2 Common Wage Violations

Again and again, we’re struck by examples of hospitals, outpatient and rehab clinics who have failed to honor the hard work of hourly nurses.

These employers routinely misclassify their nurses as “exempt” from the FLSA’s overtime provisions, unfairly round hours worked down and deduct time for “meal breaks” that were skipped to attend to an emergency.

In New York State alone, a Department of Labor investigation found that more than 64% of health care employers were violating some part of the FLSA’s wage and hour laws.

1. Missed Meal Breaks, Stolen Wages

You put your patients first. Sometimes that means working through meal breaks, especially when your facility is understaffed to begin with.

Employers are allowed to automatically deduct the time you spend eating from your hours worked, but only if you don’t actually work during that time. If you work through your meal break or are constantly interrupted by small crises, doctors with notes for you or a patient’s family members, you’re working and that time counts toward your overtime.

In 2013, more than 1,400 hourly nurses in Madison, Wisconsin recovered $3.5 million in back pay over allegations that St. Mary’s Hospital had failed to provide bona fide (duty-less) meal breaks but counted the hours as unpaid anyway.

2. Nurse Misclassification

Hundreds of registered nurses and other health care workers filed suit against Kaiser Permanente in 2007, claiming the company had fraudulently classified them as “exempt” from the FLSA’s provisions, and thus not entitled to overtime. While Kaiser never admitted wrongdoing, the company ultimately settled for $7.25 million.

But most nurses aren’t exempt. Here’s how to tell:

Am I A “Learned Professional”?

Nurses who may not be entitled to the FLSA’s wage and overtime protections are generally considered exempt under the law’s “professional” exemption.

But to be a “learned professional,” you need to meet all of the following criteria:

- You get paid a salary or fee no less than $455 every week

- Your primary job duty is performing work that requires advanced knowledge

- That knowledge is in a “field of science or learning” (medicine and pharmacy count)

- Your “advanced knowledge” was acquired through a “prolonged course of specialized intellectual instruction”

Unless you meet each of those criteria, you’re most likely entitled to overtime wages. Many nurses who receive a salary are still eligible for overtime pay.

Registered Nurses Vs. Licensed Practical Nurses

According to the Department of Labor, registered nurses who are paid hourly are entitled to overtime pay. Only RNs who are licensed by a State examining board and make a base salary of $455 or more per week may be exempt from the FLSA’s provisions.

Licensed practical nurses, on the other hand, are almost never exempt. The vast majority of LPNs are entitled to overtime wages.

When You Have No Choice: Mandatory Overtime

Part of the problem contributing to wage violations in the health care industry is mandatory overtime, a practice that has become increasingly common over the last few decades. By 2000, an American Nurses Association survey found that over 67% of nurses polled ended up working unplanned overtime each month.

Is Mandatory Overtime Illegal?

Not under the FLSA.

There is no federal law that currently restricts an employer’s ability to mandate overtime (any hours over the standard 40 considered a workweek), and no federal legislation that would stop your employer from threatening you with dismissal if you declined overtime work.

But a number of states have either banned or limited the practice of mandatory overtime specifically for nurses. To learn if you live in one of them, click here.

Regardless of where you live, the FLSA does guarantee that if you work overtime, you must be paid accordingly: at one-and-one-half your regular rate.

FLSA Basics For Other Health Care Workers

The Fair Labor Standards Act contains several nuanced exemptions that may affect health care workers. One is the “companionship” exemption, although this exemption no longer covers many of the workers it used to.

Home Health Care Services

Until very recently, in-home workers who provided “companionship services” were exempt from the FLSA’s overtime protections. They weren’t entitled to the Act’s minimum wage and overtime protections.

But as of August 21, 2015, a US Court of Appeals in Washington, D.C. says that third-party employers of workers who provide these kinds of services in a patient’s home can no longer exempt their employees from the FLSA’s overtime pay requirements.

The Department of Labor provides a basic definition of companionship:

“services for the care, fellowship, and protection of persons who because of advanced age or physical or mental infirmity cannot care for themselves.”

The specific services that we’re talking about here are things like:

- conversation

- playing games

- running errands

- accompanying the client to social events

If you perform this sort of in-home work for patients, you’re no longer exempt under the FLSA and are now entitled to overtime wages.

In-home nurses, as always, perform “domestic services” and are almost always covered by the FLSA. Certified nurse aides and home health care aides are usually guaranteed overtime pay under federal law, too.

Paramedics & EMTs

Emergency medical personnel always qualify for overtime wages, unless their duties relate “substantially” to firefighting or law enforcement.

Contact Our Lawyers

Every health care professional deserves to be fairly compensated. Under the Fair Labor Standards Act, most registered nurses, licensed practical nurses and in-home health care aides are guaranteed that much.

But wage theft is a systemic problem in the health care industry. If you’re being stolen from, we can help.

Sponsored by three experienced trial lawyers, and led by Tim Becker, Esq., WageAdvocates.com was designed to reform this broken system, one case at a time.

Tim’s faced up to big health care players before. In Lawrence v. Maxim Healthcare Services, Tim served as Co-Lead Counsel, representing a class of in-home health aides who said they had been improperly exempted from the FLSA under its companionship exemption.

Now he’s prepared to fight for what you’ve rightfully earned. To learn more about your rights under federal law, call our FLSA attorneys for a free consultation.

Great to work with! Wage Advocates were so amazing. They answered all my questions and kept me informed the whole time."Rating: 5.0 ★★★★★