Minimum Wage Increases 2017: A Complete Guide To New State & City Laws

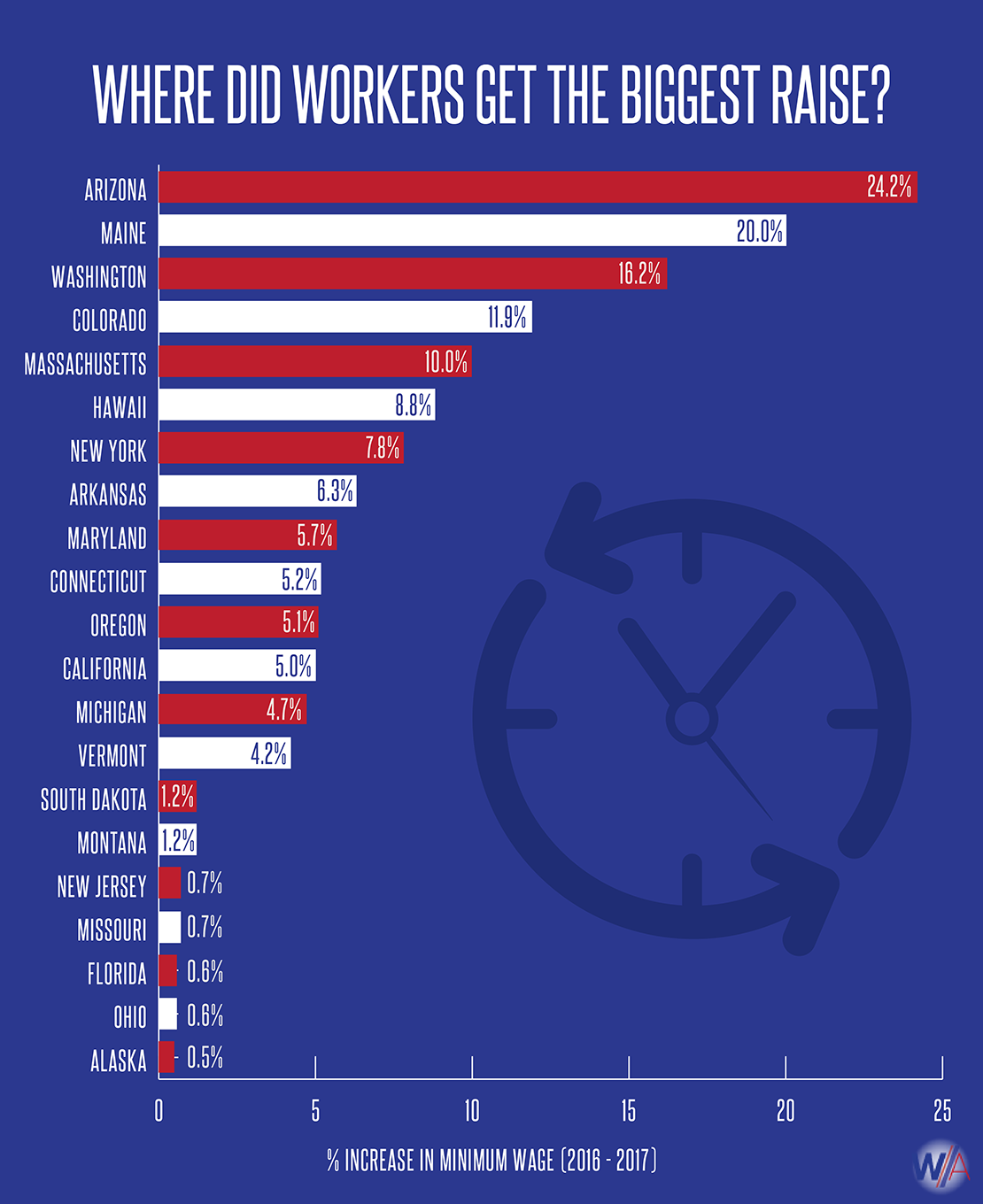

At least 21 States have raised their minimum wages for 2017, along with 10 counties and 19 cities – all of which will be giving low-wage workers a bump in pay for the new year. Many of these increases are steps on the path toward a larger goal, as more and more localities join the “Fight For 15,” a national movement for higher wages that has galvanized employees and advocates across the country.

Minimum Wage Rises In 21 States For 2017

In this guide, you’ll find every minimum wage increase set for 2017, along with helpful clarifications on state law. Most minimum wage increases, whether authorized on the state, county or city level, took effect on January 1, 2017, but keep in mind that some laws will only begin to apply towards the middle of the year.

| STATE | 2016 Minimum Wage | 2017 Minimum Wage | Date Effective |

|---|---|---|---|

| ALASKA | $9.75 | $9.801 | January 1, 2017 |

| ARIZONA | $8.05 $5.05 (tipped employees) |

$10.00 $7.00 (tipped employees) |

January 1, 2017 |

| ARKANSAS | $8.00 $2.63 (tipped employees) |

$8.50 $2.63 (tipped employees) |

January 1, 2017 |

| CALIFORNIA | $10.00 | $10.0012 (employers with 25 employees or fewer) $10.50 (employers with 26 employees or more) |

January 1, 2017 |

| COLORADO | $8.31 $5.29 (tipped employees) |

$9.30 $6.28 (tipped employees) |

January 1, 2017 |

| CONNECTICUT | $9.60 $6.62 (tipped employees; by law, 69% of minimum wage |

$10.10 $6.97 (tipped employees) |

January 1, 2017 |

| FLORIDA | $8.05 $5.03 (tipped employees) |

$8.10 $5.08 (tipped employees) |

January 1, 2017 |

| HAWAII | $8.50 $7.75 (tipped employees) |

$9.25 $8.50 (tipped employees) |

January 1, 2017 |

| MAINE | $7.50 $3.75 (tipped employees) |

$9.00 $5.00 (tipped employees)2 |

January 1, 2017 |

| MARYLAND | $8.75 $3.63 (tipped employees) |

$9.253 $3.63 (tipped employees) |

July 1, 2017 |

| MASSACHUSETTS | $10 $3.75 (tipped employees) |

$11.00 $3.75 (tipped employees) |

January 1, 2017 |

| MICHIGAN | $8.50 $3.23 (tipped employees) |

$8.90 $3.38 (tipped employees) |

January 1, 2017 |

| MISSOURI | $7.65 $3.825 (tipped employees) |

$7.70 $3.85 (tipped employees) |

January 1, 2017 |

| MONTANA | $8.05 | $8.154 | January 1, 2017 |

| NEW JERSEY | $8.38 $2.13 (tipped employees) |

$8.44 $2.13 (tipped employees) |

January 1, 2017 |

| NEW YORK | $9.00 $7.50 (tipped employees) |

$9.70 (outside of NYC, Nassau, Suffolk and Westchester Counties; does not apply to fast food workers)5 $8.10 (tipped service employees outside of NYC, Nassau, Suffolk and Westchester Counties) $7.50 (tipped food service workers outside of NYC, Nassau, Suffolk and Westchester Counties) |

December 31, 2016 |

| OHIO | $8.10 $4.05 |

$8.15 $4.08 (tipped employees) |

January 1, 2017 |

| OREGON | $9.75 (state-wide and Portland metro; active until July 1, 2017) $9.50 (nonurban counties)6 |

$10.25 (state-wide)7 $11.25 (Portland metro) 10.00 (nonurban counties) |

July 1, 2017 |

| SOUTH DAKOTA | $8.55 $4.275 (tipped employees) |

$8.65 $4.325 (tipped employees) |

January 1, 2017 |

| VERMONT | $9.60 $4.80 (tipped employees) |

$10.00 $5.00 (tipped employees) |

January 1, 2017 |

| WASHINGTON | $9.47 | $11.008 $9.35 (employees under 16 years old) |

January 1, 2017 |

Mandatory Pay Rate Increases In 10 Counties

In addition to state-wide changes, several counties have also enacted minimum wage increases that will go into effect in 2017:

| State | COUNTY | 2016 Minimum Wage | 2017 Minimum Wage | Date Effective |

|---|---|---|---|---|

| Maryland | PRINCE GEORGE’S COUNTY | $10.75 $3.63 (tipped employees) |

$11.50 $3.63 (tipped employees) |

October 1, 2017 |

| Maryland | MONTGOMERY COUNTY | $10.75 $4.00 (tipped employees) |

$11.50 $4.00 (tipped employees) |

July 1, 2017 |

| Iowa | JOHNSON COUNTY | $9.15 $5.49 |

$10.10 $6.06 (tipped employees) |

January 1, 2017 – June 30, 20189 |

| Iowa | LINN COUNTY10 | $7.25 | $8.25 $4.95 (tipped employees) |

January 1, 2017 |

| Iowa | WAPELLO COUNTY10 | $7.25 | $8.20 $4.91 (tipped employees) |

January 1, 2017 |

| New Mexico | BERNALILLO COUNTY | $8.65 $2.13 (tipped employees) |

$8.70 $2.13 (tipped employees) |

January 1, 2017 |

| New York | NASSAU COUNTY (Central Long Island) | $9.00 $7.50 (tipped employees) $9.75 (fast food workers) |

$10.00 $7.50 (tipped employees) $10.75 (fast food workers) |

December 31, 2016 |

| New York | SUFFOLK COUNTY (Eastern Long Island) | $9.00 $7.50 (tipped employees) $9.75 (fast food workers) |

$10.00 $7.50 (tipped employees) $10.75 (fast food workers) |

December 31, 2016 |

| New York | WESTCHESTER COUNTY | $9.00 $7.50 (tipped employees) $9.75 (fast food workers) |

$10.00 $7.50 (tipped employees) $10.75 (fast food workers) |

December 31, 2016 |

| California | LOS ANGELES COUNTY | $10.50 (active until July 1, 2017) | $12.0011 (employers with 26 employees or more) $10.50 (employers with fewer than 26 employees) |

July 1, 2017 |

19 Cities See Large Hikes In Wage

| State | CITY | 2016 Minimum Wage | 2017 Minimum Wage | Date Effective |

|---|---|---|---|---|

| California | CUPERTINO | $10.00 | $12.0012 | January 1, 2017 |

| California | EL CERRITO | $11.60 | $12.2512 | January 1, 2017 |

| California | LOS ALTOS | $10.00 | $12.0012 | January 1, 2017 |

| California | MOUNTAIN VIEW | $11.00 | $13.0012 | January 1, 2017 |

| California | OAKLAND | $12.55 | $12.8612 | January 1, 2017 |

| California | PALO ALTO | $11.00 | $12.0012 | January 1, 2017 |

| California | RICHMOND | $11.52 | $12.3012 | January 1, 2017 |

| California | SAN DIEGO | $10.50 | $11.50 12 | January 1, 2017 |

| California | SAN MATEO | $10.00 | $12.0012 $10.50 (employees of 501 (c)(3) non-profit organizations) |

January 1, 2017 |

| California | SAN JOSE | $10.30 | $10.5012 (active from January 6, 2017 to July 1, 2017) $12.00 (active from July 1, 2017 to January 1, 2018) |

January 6, 2017 |

| California | SANTA CLARA | $11.00 | $11.1012 | January 1, 2017 |

| California | SUNNYVALE | $11.00 | $13.0012 | January 1, 2017 |

| Maine | PORTLAND | $10.10 | $10.68 $5.00 (tipped employees) |

January 1, 2017 |

| New Mexico | ALBUQUERQUE | $8.75 $7.75 (if employer provides healthcare and / or childcare benefits during any pay period and benefits equal an annualized $2,500 or more) $5.25 (tipped employees) |

$8.80 $7.80 (if employer provides healthcare and / or childcare benefits during any pay period and benefits equal an annualized $2,500 or more) $5.30 (tipped employees) |

January 1, 2017 |

| New Mexico | LAS CRUCES | $8.40 $3.36 |

$9.20 $3.68 (tipped employees) |

January 1, 2017 |

| New York | NEW YORK CITY | $9.00 $10.50 (fast food workers) $7.50 (tipped employees) |

$11.00 (employers with 11 employees or more) $10.50 (employers with 10 employees or fewer) $12.00 (fast food workers) $9.15 (tipped service employees at companies with 11 or more employees) $8.75 (tipped service employees at companies with 10 employees or fewer) $7.50 (tipped food service workers, regardless of company size) $8.30 (tipped workers outside the hospitality industry at companies with 11 employees or more; applies when tips amount to at least $2.70 per hour) $7.95 (tipped workers outside the hospitality industry at companies with 10 employees or fewer; applies when tips amount to at least $2.55 per hour) $9.35 (tipped workers outside the hospitality industry at companies with 11 employees or more; applies when tips range between $1.65 per hour and $2.70 per hour) $8.90 (tipped workers outside the hospitality industry at companies with 10 employees or fewer; applies when tips range between $1.60 per hour and $2.55 per hour) |

December 31, 2016 |

| Washington | SEATTLE | $13.00 (employees at companies with 501 or more employees nation-wide; applies if employer does not pay medical benefits) $12.50 (employees at companies with 501 or more employees nation-wide; applies if employer pays medical benefits) $12.00 (employees at companies with 500 employees or fewer; applies if employer does not pay medical benefits) $10.50 (employees at companies with 500 employees or fewer; applies if employer pays medical benefits) |

$15.00 (employees at companies with 501 or more employees nation-wide; applies if employer does not pay medical benefits) $13.50 (employees at companies with 501 or more employees nation-wide; applies if employer pays medical benefits) $13.00 (employees at companies with 500 employees or fewer; applies if employer does not pay medical benefits) $11.00 (employees at companies with 500 employees or fewer; applies if employer pays medical benefits) |

January 1, 2017 |

| Washington | SEATAC | $15.00 | $15.34 | January 1, 2017 |

| Washington | TACOMA | $10.35 | $11.15 | January 1, 2017 |

1Alaska has a key exception to its general minimum wage requirements: school bus drivers are entitled to twice the state’s minimum wage, now $9.80 per hour. In short, school bus drivers in Alaska should make at least $19.60 an hour in 2017, in line with the state’s School Bus Safety Act, passed in 1989 to recognize the uniquely rigorous training required of licensed school bus drivers. Additionally, the state of Alaska does not allow employers to take a tip credit. Employees in the state are entitled to the full minimum wage, now $9.80 per hour, regardless of their tips.

2Referencing “potential legislative action,” Governor Paul LePage announced on December 15, 2016 that Maine’s labor department would not begin enforcing the change in the state’s minimum wage for tipped employees until January 31, 2017. Before that date, Maine employers will not face penalties for violating the state’s new minimum wage increases, which entitle tipped employees to at least $5.00 per hour in cash wages and allow employers to take a tip credit of only $4.00 an hour. More on the Governor’s reasoning, which does not restrict a worker’s right to sue for unpaid back wages, at the Boston Globe.

3In Maryland, employees at amusement and recreational establishments are entitled to at least 85% of the state’s governing minimum wage rate or $7.25 per hour, whichever wage is higher. As a result, these workers will become entitled to $7.86 per hour on July 1, 2017. Throughout all industries, employees under the age of 20 in Maryland can be paid 85% of the state’s minimum wage, or $7.86 per hour, but only for their first six months in a job.

4Montana law does not allow employers to take a tip credit, per the state’s Department of Labor & Industry. In other words, tipped employees are always entitled to the state’s current minimum wage, now $8.15 per hour, in addition to any tips they make.

5New York State is currently home to 14 different minimum wages.

6As outlined by Oregon’s Bureau of Labor & Industries, “nonurban” counties include:

- Baker

- Coos

- Crook

- Curry

- Douglas

- Gilliam

- Grant

- Harney

- Jefferson

In these counties, minimum wage workers will be entitled to at least $10.00 per hour, beginning on July 1, 2017. Before that date, employees are entitled to at least $9.50 an hour.

7Oregon is one of the few states that does not allow employers to take a tip credit. Tipped employees in the state are entitled to a cash wage of at least $9.75 per hour, no matter how much they make in tips.

8Washington State does not have a separate minimum wage for tipped workers.

9After June 30, 2018, Johnson County‘s minimum wage will become tied to the Consumer Price Index, increasing or decreasing in line with changes in the cost of living.

10Cities (technically, “incorporated municipalities”) in Linn and Wapello Counties have the right to opt out of the county’s minimum wage increase, according to the Des Moines Register. The rate change applies automatically to unincorporated areas in both counties.

11The minimum wage increase in Los Angeles County applies only to unincorporated areas in the county. As reported by NBC Los Angeles, employers with fewer than 26 employees have an extra year to adjust to LA County’s minimum wage increases. In other words, those companies will not be required to pay their workers a minimum wage of $12 per hour until July 1, 2018.

12The State of California does not allow employers to take a tip credit when paying tipped employees. In other words, every tipped worker in California is entitled to the relevant minimum wage, in addition to their tips. This is true regardless of any differences that may exist between a city or county’s minimum wage and the state’s general minimum wage.