Is It Illegal To Not Pay Overtime?

Do employers have to pay overtime? To frame the question in a slightly different way, are all employees entitled to overtime wages?

The answer is no, not necessarily. Overtime is not a universal right in the United States. There are some workers who aren’t legally entitled to overtime pay (it depends on what kind of work you do at your job, along with how much you make), and some very small companies that don’t need to pay overtime wages to any of their employees.

The vast majority of businesses are covered by the Fair Labor Standards Act, an extremely important federal labor law. According to the Fair Labor Standards Act, or FLSA, most employees in the US should be making higher wages when they work more than 40 hours in a week. That means time-and-a-half, or overtime pay, is required for the vast majority of workers.

When Is Not Paying Overtime Illegal?

The answer to that question depends mainly on what kind of work you do and then, to a lesser extent, on how much you already make. Before explaining the overtime exemptions outlined by federal law, let’s back up a bit.

The federal law that addresses overtime requirements is called the Fair Labor Standards Act (FLSA). It also sets out minimum wage and child labor laws, but all of the labor protections it defines “cover” the vast majority of American workers. Some businesses, however, aren’t “covered” and employees at these companies, no matter what they do, probably aren’t entitled to overtime.

Do I Work For A Covered Business?

In most cases, the FLSA covers businesses that:

- engage in interstate commerce (that’s business between states, because it’s federal, not state, law), or

- make sales of at least $500,000 annually (so very small businesses aren’t burdened by wage requirements they can’t afford)

You probably work for a covered business. Courts usually take a very broad interpretation of “interstate commerce.” Because the internet almost always uses servers in different states, sending emails is often enough to get a company’s activities labeled as “interstate commerce.” Using the US postal service regularly is considered interstate commerce, too.

Don’t know if your employer is covered by the FLSA? Check with our unpaid overtime lawyers for free. Just call 877-629-9275 or fill out a contact form on our website. We’ll walk you through your legal situation at no charge.

Am I An Exempt Employee?

Now we can get down to actual employees. Every worker at a covered business is either exempt or non-exempt. Non-exempt employees are entitled to overtime wages, while exempt workers are not. Exempt workers fall into one of the FLSA’s “exemptions,” some of which are very broad definitions and some of which are narrow and occupation-specific.

White Collar Exemptions

The broad exemptions are sometimes called “white collar” exemptions, and whether or not you fit into one of the categories has almost everything to do with the nature of your job duties. But first, take stock of how much you make and how you make it. To fit into any of the white collar exemptions, you need to make:

- a salary (a certain predefined amount of money that doesn’t change depending on how much you work)

- at least $455 per week (if you get paid every two weeks, at least $910, or $23,660 per year)

Don’t make a salary, or make a salary lower than $455 per week? It’s very likely that you’re entitled to overtime wages. At this point, it doesn’t matter what kind of tasks you perform at work. If you don’t meet the “salary threshold” for overtime (at least $23,660 per year paid no matter how many hours you work), then you are entitled to overtime wages. It would be illegal, in this context, for your employer to not pay you overtime pay.

On the other hand, if your job satisfies the two criteria we listed above, and you make a salary of at least $23,660 per year, your eligibility for overtime will depend on what you do at work.

What Is An Executive?

Now we can consider your job duties. We’ll start with the category of exempt workers that the Fair Labor Standards Act considers “executives”:

- Do you manage the company, or one of its divisions?

- Do you “direct” the work of at least two other, full-time employees? Delegating tasks, making up schedules and the like?

- Do you have some real authority over personnel decisions, like hiring and firing? That’s not necessarily being able to hire or fire people, but your suggestions as to personnel should have some real weight.

If so, you may be properly classified as an “executive” under federal law. Executives who satisfy the salary threshold are not entitled to overtime pay.

What Is An Administrator?

Let’s look at another class of exempt worker, administrative employees.

- Do you perform office (or other non-manual) work related to the management or business operations of the enterprise?

- Do you regularly use independent judgment to make important decisions? Rather than relying on a manual, do you have the leeway to think critically about several choices and then pull the trigger on one?

If so, you might be an “administrator.” Administrators, like executives, aren’t entitled to overtime wages.

What Is A Professional?

Finally, we’ll take a look at “professionals,” our last type of white collar employees.

- Do you perform work that requires “advanced knowledge” in a field like medicine, law or architecture?

- Is that work traditionally considered “intellectual,” rather than routine or manual labor?

- Did you earn an advanced degree for the field you work in?

Think you fit the bill? You might not be entitled to overtime. Lots of working artists are also considered “professionals” by the FLSA.

Specific Occupations

After defining those broad categories of exempt employees, the FLSA digs into specific industries where federal overtime requirements don’t apply:

- fishing

- farms

- movie theaters

- seasonal amusement businesses

- small newspapers

- small television and radio stations

Note that these particular exemptions can be up for debate. Deciding whether a specific employee is exempt is a meticulous process, done on a case-to-case basis. You may seem exempt, but not actually be exempt.

Almost every other worker in the US is legally entitled to overtime, and should be making more for their extra hours.

I’m Not Exempt. But I’m Not Making Overtime.

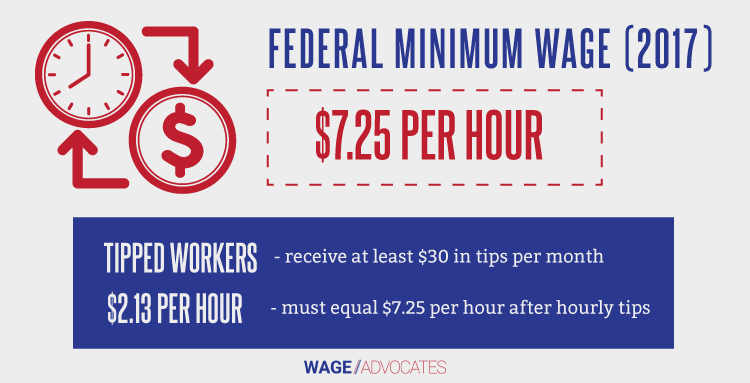

You’re not alone. Some studies suggest that the majority of US employees become the victim of wage theft at some point in their working lives. Millions of low-wage workers are also losing out due to violations of the minimum wage, another aspect of labor law controlled by the Federal Fair Labor Standards Act.

Not being paid for overtime? Making less than minimum wage for your hours? We can help. Our experienced unpaid overtime lawyers have stood up to employers big and small, and we’re prepared to defend your rights aggressively.