Feel free to share our overtime calculation infographic on your own site. Just copy and paste the code below:

https://wageadvocates.com/wp-content/uploads/How-To-Calculate-Overtime-Wages-Infographic-Revised.png

Knowing how to calculate your correct overtime wages is crucial. Every day, millions of employees lose out on their earned overtime due to overtime violations. The lesson is clear – your employer may be taking advantage of you, but without following your own hours, you would never know.

The Department of Labor has an overtime calculator that can help. It’s extremely comprehensive, with different calculators for workers who make tips, salaries and hourly wages.

How Do You Calculate Overtime Pay?

We suggest tracking your hours on a weekly basis and figuring out how much you’re owed under federal law. Then check to make sure that your paycheck or cash wage reflects your real pay. That’s the best, and often the only, way to catch a wage and hour violation.

Basic Overtime Calculations: How To Add Up Overtime

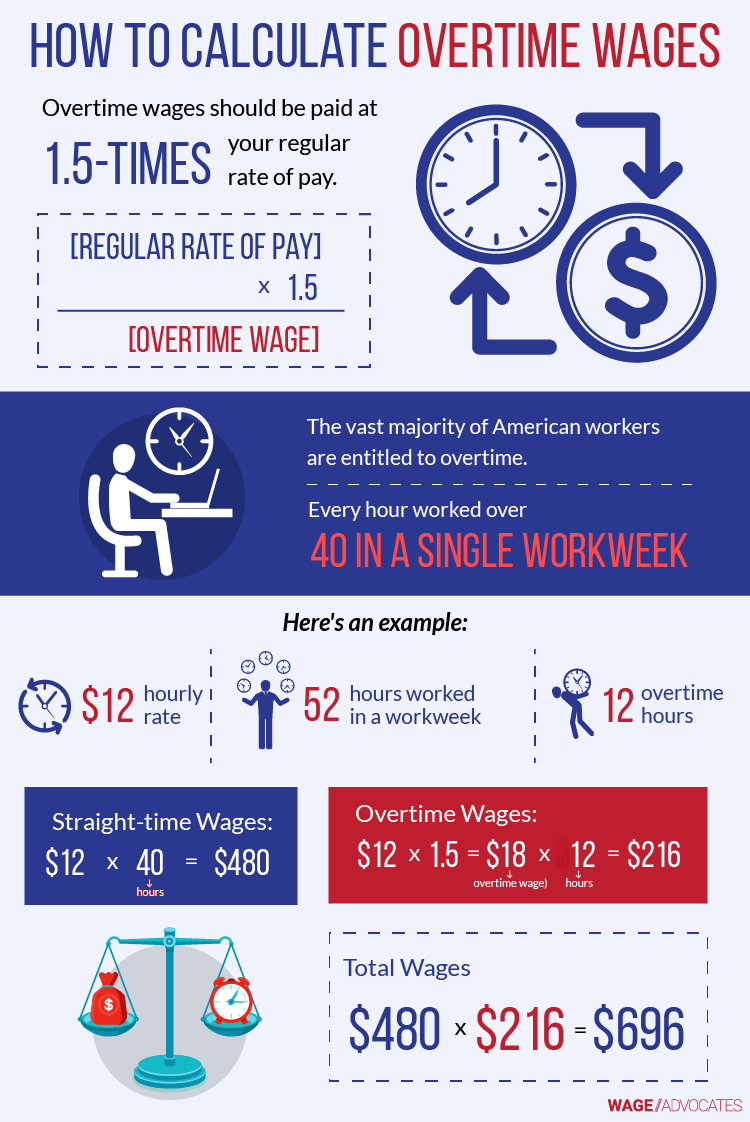

According to federal law, the vast majority of workers in America are entitled to overtime. Overtime wages are always calculated at 1.5-times (150%) your regular rate of pay. Overtime kicks in after you’ve worked 40 hours in a single workweek, whether that weeks starts on Monday, Tuesday or Friday.

Make an hourly wage? Calculating your overtime wage is simple. Just multiply your regular rate of pay by 1.5.

If you normally make $8 per hour, your overtime wage is $12, because that’s $8 times 1.5. And if you make $16 per hour normally, your overtime rate should be $24 – again, that’s $16 multiplied by 1.5. Note that calculations get a little more complicated when you make bonuses or commissions; we’ll get to those complexities a little later in this guide.

If I Get Paid $9 An Hour, How Much Is Overtime?

Make $9 per hour? Our overtime calculation will be the same as above. Your overtime wage should be paid at $13.50, because that’s $9 multiplied by 1.5.

Also be aware that several states (most notably California) have passed overtime laws of their own; many of these state-specific overtime regulations are more generous than the federal minimum. You are always entitled to the higher wage. When your state’s overtime law conflicts with the federal overtime law, you deserve the most money possible.

Different Calculations Based On Your Circumstances

If you’ve already determined that you’re entitled to overtime under the Fair Labor Standards Act (FLSA), you’re considered a “nonexempt” worker under federal law. How you calculate your extra wages will depend on how you get paid. Click on one of the links below to learn more about the different situations:

- I make an hourly wage.

- I make more than $30 in tips every month.

- I make a salary.

- I work a “fluctuating” workweek.

Before we begin, note that overtime is always calculated on a weekly basis; averaging two or more weeks together to get around the 40 hour limit is illegal. For every week, you’ll consider the hours you actually worked, how much you’re normally paid and determine your overtime wages based on those numbers.

Remember: nonexempt workers are entitled to one-and-a-half (1.5-times) their regular rate for all hours worked over 40 in a workweek.

Hourly Employees

1. Add up all the hours you worked in the week.

For the sake of argument, let’s say you worked 48 hours this week. Hours worked must include all pre- and post-shift work you do, as well as lunch breaks that get interrupted by your duties. Whenever you’re actually working, you deserve to get paid for it.

2. Take your regular rate, your normal hourly wage, and multiply it by 1.5.

Assume you make $9 per hour normally. That’s your regular rate. Multiply that regular rate by 1.5 – $9 times 1.5 equals $13.50. That’s your overtime rate.

3. Calculate your “straight-time” pay first. That’s how much you made for the first 40 hours you worked.

Multiply 40 hours by $9 per hour, your regular rate. 40 hours times $9 per hour is $360.

4. Now work out your overtime hours.

Take the 8 hours of overtime you worked and multiply them by your overtime rate, $13.50. 8 times $13.50 equals $108.

5. Add your overtime wages to your straight-time wages.

$360 plus $108 equals $468. Those are your proper wages for the week.

Want to do this calculation quickly? Check out our overtime calculator here.

Tipped Employees

Employers are allowed to take a “tip credit” for workers who make regular tips. On the surface, this tip credit reduces your cash wages below the applicable minimum wage, but your amount of tips should make up for it. Added together, the tip credit plus your cash wages have to be at least the minimum wage. As we’ll see below, tip credits also work their way into overtime calculations.

Let’s say you make good tips and your employer takes the maximum tip credit allowed by federal law: $5.12, making the cash wages they actually pay you $2.13 – that’s $7.25, the federal minimum wage, minus $5.12. Your employer pays you an hourly rate of $2.13 per hour, but your tips make up for it, because you make $5.12 or more in tips on an hourly basis. You’re still being compensated at at least the minimum wage. Again, your hourly tip rate, plus your cash wage, must always add up to at least the minimum wage.

For overtime, your employer is not allowed to start with that low cash wage of $2.13 to calculate your overtime rate; they have to use at least the minimum wage. If your tips and cash wage add up to an hourly wage higher than the minimum, they have to use that higher wage.

1. Add up all the hours you worked this week.

Let’s say you worked 46 hours.

2. Take the federal or state minimum wage and multiply it by 1.5.

The FLSA minimum wage is $7.25. Multiplied by 1.5, that makes $10.88.

3. Subtract the tip credit from the amount in (2).

$10.88 minus $5.12 equals $5.76. That’s your overtime rate.

4. Use that new number to calculate your overtime wages.

Since you worked 6 hours more than 40, multiply 6 by $5.76 to get $34.56.

5. Calculate your straight-time pay for the week.

Multiply 40 hours by your straight-time wage of $2.13, which equals $85.20.

6. Add your straight-time wages to your overtime wages.

Now add your overtime wages – $85.20 plus $34.56 equals $119.76. Those are your total cash wages for the week.

Salaried Employees

Some employees who make a salary are entitled to overtime, although many employers don’t honor that right. To learn if you’re entitled to the FLSA’s protections, click here.

1. First, check your contract to find out how many hours you’re expected to work each week.

For this example, we’ll say your salary covers 35 hours of work per week. Assume that, this week, you worked 45 hours.

2. Now take your weekly salary (if you get paid bi-weekly, just divide your salary by 2 first) and divide it by the hours it’s meant to compensate you for.

Let’s say you get paid $460 every week. Divide $460 by 35 to get $14.46.

That’s your straight hourly rate, not your overtime wage. We’ve simply converted a salary into an hourly wage.

3. Since your salary is only meant to cover 35 hours, 5 hours less than the 40 required before overtime, those 5 extra hours that bring you to 40 should be paid at the hourly wage we just calculated.

5 times $14.46 is $72.30.

4. Then work out your overtime, multiplying your overtime rate by your hours over 40.

$14.46 multiplied by 1.5 is $21.69. That’s your overtime wage. Multiply $21.69 by your overtime hours, 5, and you get $108.45.

5. Now add everything up:

Add your base salary, $460, to the amount we got in (3), $72.30, and then add your overtime, $108.45, for a total of $640.75. That’s how much you should make for the week.

Chinese Overtime

Chinese overtime is complicated. Check out our full guide on Chinese overtime to find out how the Fair Labor Standards Act deals with “fluctuating workweeks,” where the amount of hours you work changes from week to week. Chinese overtime is frequently illegal. To pay Chinese overtime, which is paid at one half (0.5) your regular rate of pay, employers need to meet 5 important and necessary conditions. In many cases, these conditions aren’t met.

If you make Chinese overtime, it’s extremely important to understand how much money you should actually be making. We cannot stress this enough. Learn how Chinese overtime should be paid. It’s the only way to ensure that your rights aren’t being violated.

1. Consider Your Weekly Salary

For Chinese overtime to be legal, you need to be paid a set amount of money each week, no matter how many hours you actually work.

Let’s say you make $420 every week. Your pay doesn’t change, no matter what happens. Whether you work 2 hours a week or 52 hours a week, you get paid $420.

2. Check To Make Sure You Made The Minimum Wage

Another requirement of Chinese overtime? You need to make at least the minimum wage for the week in question. Convert your weekly salary into an hourly wage.

Assume that you worked 46 hours in a week. Now convert your weekly salary into an hourly wage. You made $9.13 an hour, which is $420 divided by 46 hours. That’s above the federal minimum wage of $7.25, which means that your employer can pay you Chinese overtime. If your hourly wage is below the minimum wage, your employer is not allowed to pay you Chinese overtime, and may already be breaking the law.

3. Calculate Your Overtime Wages

You worked 6 hours over 40 in the week, and we’ve already determined that you can legally be paid Chinese overtime. Your employer is allowed to pay your overtime wages at one-half (0.5-times) your regular rate of pay.

Your regular rate of pay is $9.13, the hourly rate we calculated earlier. To calculate your overtime wages, multiply your regular rate by 0.5, or half. Half of $9.13 is $4.57 – that’s your overtime wage.

Now multiply your new overtime wage by your overtime hours, 6. 6 hours times $4.57 is equal to $27.39. Those are your correct overtime wages for the week.

4. Add Your Overtime Wages To Your Straight Salary

Now we need to put it all together. Take your regular salary, $420 per week, and add your overtime wages. $420 plus $27.39 is equal to $447.39. That’s how much you should be paid for your week of work.

What If My Calculation Doesn’t Match What I’m Paid?

Try tracking your hours, calculating your correct overtime rate and checking it against what you actually make. Do they match?

If not, your employer may be violating your wage and hour rights. Contact the lawyers at WageAdvocates.com to learn more about getting back double what you earned. Our experienced attorneys have already helped hundreds of employees secure compensation for their unpaid overtime wages, and some workers could be entitled to liquidated damages, which could double your unpaid earnings in a court judgment or settlement.

Standing up to your employer can seem terrifying. We understand. Our compassionate legal team helps you stand up for your rights with confidence. You are protected by federal law. Your employer is not allowed to punish you for exerting your rights under the Fair Labor Standards Act. If you get fired, or demoted, or have your pay cut, you may become eligible to file a second lawsuit, for illegal retaliation, and could win even more compensation.

Learn more about your legal options in a free, confidential consultation today. You don’t have to make any big decisions just yet. Filing a wage and hour lawsuit is a major decision, one you can’t take lightly. Our dedicated attorneys can help walk you through your rights so you better understand your legal options. Your consultation is free and comes at no obligation.

Thank you! It was such a relief to know that Wage Advocates were working hard to get me compensation for my unpaid overtime."Rating: 5.0 ★★★★★