We are a Minnesota Law Firm

We Can Only Help You With Cases If You Work In Minnesota

If your employer is not paying you, and you are NOT from Minnesota, then please search Google for “Last Paycheck Lawyer in [insert your state]”

Federal law set forth in the Fair Labor Standards Act (FLSA) protects all workers in fundamental ways, no matter their occupation or legal documentation status. As a worker, your most fundamental right under the FLSA is to be fully compensated for the work you’ve performed.

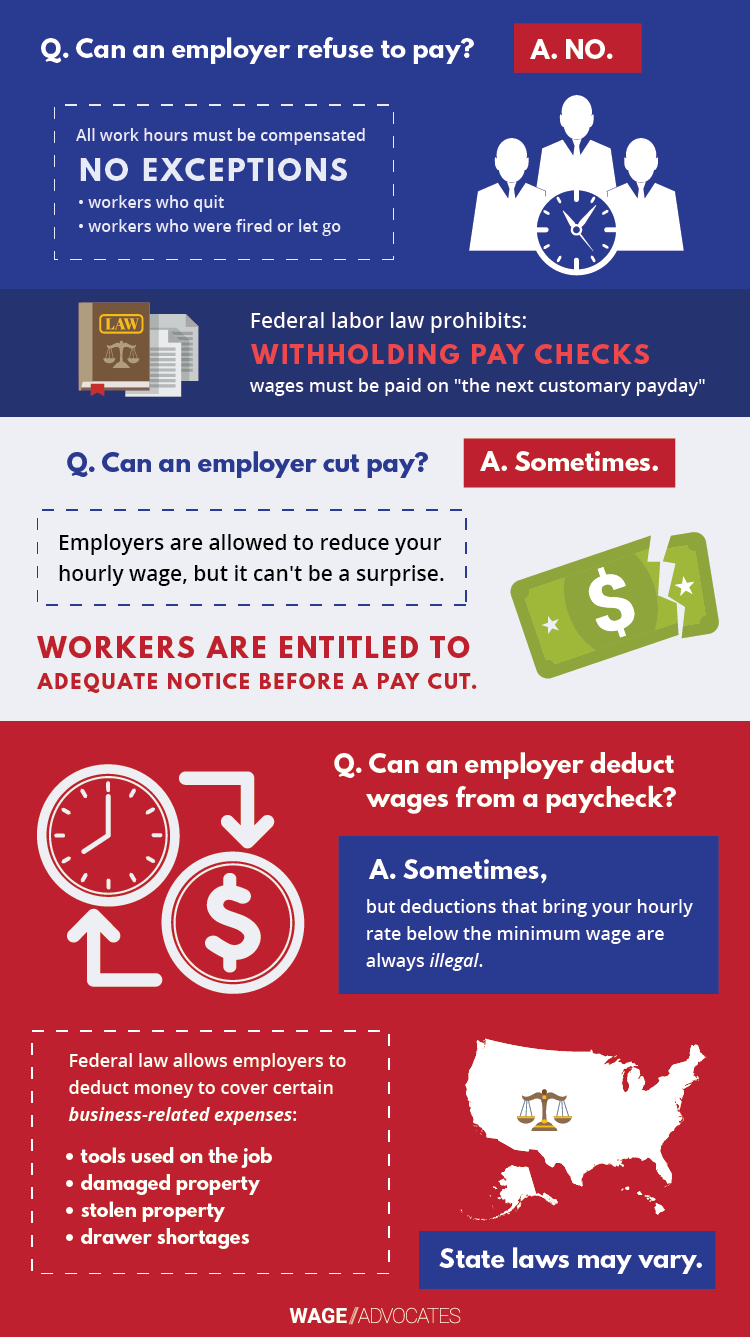

Can An Employer Refuse To Pay Me?

Absolutely not.

All the money you’ve earned is your property. If your employer refuses to pay you what you’ve earned, you have every right to sue them for those unpaid wages.

This is also true for workers who quit or were fired and haven’t yet been compensated for their final days or weeks of labor. If you worked before your termination, you made money and deserve to see it. Once more, these unpaid wages are a crime, and you have the right to seek remuneration.

Can My Check Be Withheld From Me?

No.

Under the FLSA, it’s unlawful for an employer to withhold your paycheck, regardless of their reason. Even being paid late may be considered an infringement of federal law.

My employer didn’t pay me, what can I do?

Employers are legally required to pay their workers’ wages on the next customary payday for the preceding pay period. There are no exceptions to this rule and many states have instituted laws that penalize employers who are late in paying their workers. Simply put, during the days you are forced to wait for your due paycheck, your compensation can be considered unpaid wages, which gives you the right to sue or pursue a legal claim.

Can My Employer Cut My Pay?

Sometimes.

In most cases, your employer may reduce your salary or hourly wage (unless it falls below the applicable federal or state minimum wage), but only if they tell you beforehand.

Generally, pay cuts shouldn’t be a surprise. If you were shocked to learn that your wage was cut, you may be the victim of wage theft and be entitled to compensation larger than the amount of the unpaid wages.

If your employer decides to reduce your wages, you have to be paid for any hours worked before you agree to the reduction at your old, higher wage. This is also true in cases where employees get paid by the day.

Let’s say you get paid on Fridays. You work Monday and Tuesday, and then on Wednesday, your boss says that they’re reducing your hourly wage. If you agree to the reduction, the hours you worked on Monday and Tuesday must be paid at your original rate.

If, on the other hand, your boss cut the wage for all the hours you worked that week, she would be committing a wage and hour violation.

For a reduction in your wages to be legal, you have to agree to the lower wage. But you can’t just say, “Nope. I think I’ll continue working at the higher wage.” In America, where employment is “at-will,” the only way for you to disagree with a new (lower) wage is by quitting.

Can My Employer Deduct Money From My Paycheck?

There are certain situations in which your employer can legally deduct wages from your paycheck to cover business-related expenses.

On the other hand, it’s never legal if the pay cut makes your hourly rate fall below the applicable minimum wage.

Certain deductions aren’t just legal, they’re required by law:

- Federal and state income taxes

- Social Security tax

- Court-ordered deductions, like child support

Under the FLSA, employers are allowed to deduct from wages to cover the cost of tools used on the job, damaged property, theft, or if customers walk out without paying the bill.

Some states, like Colorado and Massachusetts, have made it much harder for employers to dock pay for drawer shortages or property damage. Other states, like Tennessee, have taken the position that deductions must be agreed upon, in writing, beforehand. It’s a good idea to take a look at your own state’s regulations on this issue.

But again, the deductions can’t lower your wage below the minimum. Employers sometimes work around this requirement by dividing the item’s cost over a period of days or weeks and deducting smaller amounts from your paycheck. That’s legal, as long as you don’t go below minimum wage.

To learn more about legal and illegal paycheck deductions, visit the Department of Labor.

Can My Employer Cut My Hours?

Many businesses are still struggling with the after-effects of the Recession, and we’ve heard from many workers whose hours have been cut simply to save their employers money.

For non-exempt employees, and primarily hourly workers, this is entirely legal. Employers are allowed to cut their employees’ hours or impose a “furlough,” which is when you’re required to take one day off every week or month. But they still have to pay you for every hour that you work.

A problem can arise if employers cut hours, but demand the same amount of work be completed. Obviously, we don’t think this is fair. It becomes illegal if you have to work outside of your scheduled hours, or on your furlough day, but aren’t being compensated for the time it takes to “pick up the slack.”

If you work and your labor benefits your employer, you deserve to be paid for that time.

I Make A Salary. Can My Pay Be Cut?

Yes, but the drop in your salary may alter how you’re viewed by the FLSA.

Some employees are considered “exempt” from the FLSA. They’re not entitled to the minimum wage or overtime pay. Being exempt is largely a matter of what you do at work, but it also depends on your salary.

If you were formerly “exempt,” but your salary (a guaranteed amount you make, regardless of how many hours you work) has now dropped below $455 per week, you’re no longer exempt. That means you’re entitled to overtime pay.

How Much Can You Sue an Employer for Not Paying You?

Think you were paid improperly – or not paid at all – for your labor? Then you have two basic options: either file a lawsuit in court or file a formal complaint with the US Department of Labor (a federal agency) or your state’s Labor Department.

What to Do When Employer Refuses to Pay You?

In either case, though, it’s probably best to write up a demand letter to your employer first. It doesn’t have to be complicated, just a simple explanation that you’re owed money, and how much you want to collect. Send it to your employer (return receipt requested), keep a copy for your own records, and see what happens. Who knows? Your employer may fork over the wages you earned. Even if they don’t, sending your employer a demand letter has another beneficial side-effect.

Employer retaliation is very real. It happens; people may get fired, demoted or have their hours cut for speaking up. But proving that an employer took action because an employee spoke up can be difficult. After all, there are many legitimate reasons for firing someone, just as there are illegitimate reasons. In the event of retaliation, a prior demand letter may act as evidence in a claim that your employer was put on notice about their wage violations. It’s certainly evidence that you tried to work through your differences without involving the courts, but things got out of hand.

Small Claims Court

Small claims courts are informal and relatively inexpensive venues for resolving minor disputes. Small claims court can be a good option for people who are seeking fairly low amounts of back wages, since going to trial in a federal or state court can be expensive. Lawyers don’t usually get involved in a small claim given that the financial stakes are so low. Some states may even prohibit lawyers in small claims court. There’s no jury, either; your evidence and arguments, as well as those laid out by your employer, will be scrutinized and decided upon solely by a small claims court judge. In some cases, this may be a downside. It’s not guaranteed that a small claim judge will understand all the nuances of labor law.

Each state has its own limit on the claim that you can file in small claims court, ranging from $3,000 to $10,000. If you’re owed more than your state’s limit, but still want to file a lawsuit, you’ll have to do so in a larger court – and that probably means hiring an attorney.

Federal & State Courts

One important question to ask is whether your unpaid wages problem is individual, limited only to yourself, or collective. Are a larger group of employees being deprived of their rights? This is often the case since many employers rely on company- or position-wide payment strategies that violate federal state laws. Banding together might be the solution.

Many wage and hour lawsuits may be filed as class actions, which allows the cost of an attorney to be split fairly among all the people who could benefit from a successful resolution.

It’s best to speak with an experienced attorney about whether or not your claim could be the foundation of a viable lawsuit.

Thank you! I worked a long time without proper overtime pay and Wage Advocates helped me get compensation."Rating: 5.0 ★★★★★