Most employees in the US are entitled to overtime pay under the Fair Labor Standards Act (FLSA), a comprehensive federal employment law. But some aren’t, and the rules can be complex.

Workers who are “exempt” from FLSA overtime aren’t entitled to higher rates when they work over 40 hours in a week.

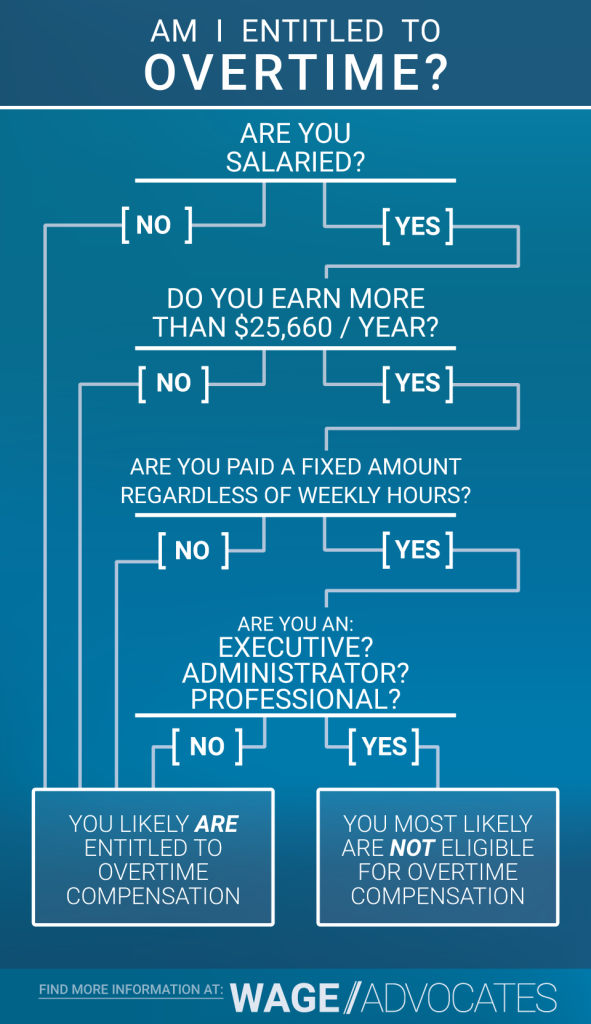

Should You Be Making Overtime Pay?

Here’s how to find out if you’re exempt.

- You have to work for a “covered” employer, but most businesses qualify.

- You have to be a true “employee,” as opposed to an independent contractor. Under new guidelines published by the Department of Labor, most workers currently classified as independent contractors may now be misclassified. That’s a wage and hour violation and you may be entitled to double the wages you’re owed.

- You have to perform “exempt” labor.

The FLSA defines a number of “exemptions,” types of workers who are not entitled to overtime.

Some of these exemptions relate to specific jobs, but more often than not, they explain broad categories that depend on how much control you exert, either over the way you work or over other employees.

Beyond the “independent contractor” exemption, most employers rely on three “white collar” exemptions to illegally deny their workers overtime. To find out if you can be classified as a “white collar” executive, professional or administrator, click here.

Can Salaried Employees Get Overtime?

Yes, but one of the most common myths about the FLSA is that as a rule salaried employees don’t make overtime wages. That’s a lie.

Part of the problem is that federal labor laws make salaries a prerequisite for those “white collar” exemptions.

For example, to be properly classified as an exempt executive, you need to:

As we can see, making a salary is required to be considered an “executive.” But it’s only one part of the equation, and your job needs to satisfy all three for you to be truly exempt.

In short, some workers on a salary should be making overtime; it depends on the kind of work you do.

Follow the link to learn more about salary employee rights.

How Does Overtime Pay Work?

If you’re entitled to overtime under the FLSA, overtime is pretty simple:

- you need to be paid for all the time you work, whether or not your boss explicitly delegates a task or not. If you’re employer can reasonably expect to benefit from your labor, that’s work and you should get paid for it.

- If you work more than 40 hours in any one week, you’re entitled to overtime for that extra work.

Overtime must be calculated at one-and-one-half your regular rate. To learn how salaried employees should calculate their regular rate, click here.

When Does Overtime Start?

Federal law starts the overtime clock ticking after 40 hours, but some states have daily overtime rules, too.

In California, covered employees who work more than 8 hours in a single day are entitled to overtime wages for the extra hours. Alaska, Nevada and a few other places have similar laws.

Find the specific employment regulations governing your workplace at Overtime & Minimum Wage Laws: State By State.

Am I Entitled To Holiday Pay?

Not unless you actually work on the holiday. The FLSA doesn’t require employers to pay for hours that aren’t actually worked, which would include holidays.

Holiday pay is only mandatory when it’s a part of an employment contract agreed-upon by an employer and employee or their union.

Some government contracts mandate “fringe benefits,” like holiday pay. The Department of Labor has a guide for government contractors and subcontractors who may be entitled to pay on holidays.

What About Vacation Pay?

Vacation pay isn’t mandatory, either.

Thank you! It was such a relief to know that Wage Advocates were working hard to get me compensation for my unpaid overtime."Rating: 5.0 ★★★★★