Do You Have To Pay Overtime?

Most employers are required to pay at least some of their employees overtime. Federal and state laws ensure that the vast majority of workers are legally entitled to overtime pay – time-and-a-half – for extra hours on the job.

Do Employers Have To Pay Overtime?

Some employees, though, aren’t afforded this basic labor protection. In legal terms, these workers fall into one of several “exemptions,” specific gaps written into national and state wage and hour laws.

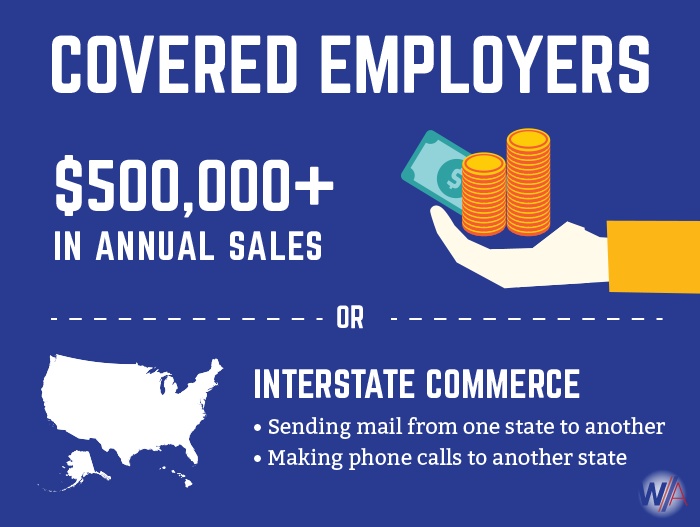

Likewise, some employers aren’t covered by the laws, which means they aren’t required to pay any of their employees overtime. Most employers making at least $500,000 in annual sales are covered by the Fair Labor Standards Act, a federal law that controls minimum wage and overtime requirements in the United States. In essence, the law was written so that small companies don’t have to pay overtime, often because they can’t afford it.

Small and extremely local, however, would be more accurate. The Fair Labor Standards Act applies to any business that engages in “interstate commerce,” even if it sells less than $500,000 per year. By “interstate commerce,” lawmakers and labor officials mean doing business between states, but regulators have taken a very broad interpretation of this phrase. Just sending mail from one state to another, or making phone calls to another state, can count as interstate commerce. Using that metric, the vast majority of businesses are covered by the Fair Labor Standards, no matter how much money they bring in.

Not For Specific Workers, Like Fishers

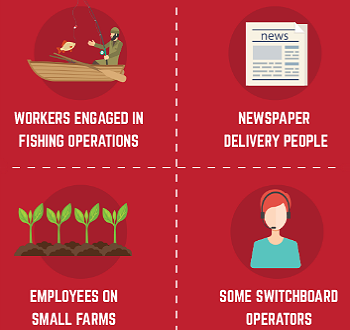

Since the Fair Labor Standards Act covers all but the smallest, and most-local businesses, exempt workers are usually considered ineligible for overtime pay because they fall under exemptions written into the law. Some of these exemptions apply to specific types of employees. Workers who engage in fishing operations, for example, are exempt from the Fair Labor Standards Act. Newspaper delivery people are also exempt, as are workers on small farms.

For workers who fall under one of these exemptions, there is no requirement to pay overtime wages, or the minimum wage for that matter (in most cases, at least). Where these employees are concerned, the answer to “do you have to pay overtime?” is a firm “no.”

Behind each of these specific exemptions is a story.

Not For “White Collar” Employees

Of course, commercial fishers and newspaper delivery people make up a very small percentage of the US labor force. Most workers who are exempt from the nation’s overtime requirements are exempt because they fall into a “white collar exemption.” These are more general exemptions that were carved out of the Fair Labor Standards Act so that employers didn’t need to pay traditionally “white collar” employees overtime. The logic being that if you already make enough money, you don’t need any extra help.

While these exemptions are most common, they also happen to be more confusing. White collar exemptions are defined by three factors:

- the workers makes a salary, rather than being paid by the hour

- the worker’s salary needs to be sufficiently high

- the worker’s job duties need to meet certain tests

The salary requirement is pretty straight-forward. If you make a set amount of money every week, regardless of how much you actually work or how well you work, you’re on a salary.

Note, though, that some employees are only salaried in a nominal sense, but not in fact. Let’s say that you think you get a salary, but your employer docks your pay for going to the doctor. Federal law doesn’t care what you’re called. All that matters is how you are treated. Since docking someone’s pay is, in a sense, paying them based on hours worked, you’d have a good case that you were an hourly employee, at least for that week. As an hourly employee, you would likely be entitled to overtime wages.

Salary Threshold

The next consideration is how much your salary is. The current regulation is that any worker making at least $455 per week can be considered exempt, depending on their job duties.

President Obama, however, wants to raise this “salary threshold,” to $970 per week. That would make an additional 4 million workers – who make between $454 and $969 per week – eligible for overtime pay, but the President’s initiative has met with strong resistance. In fact, the House just passed a bill that would delay the threshold increase by another six months, according to The Hill. Obama’s goal is to have the salary threshold increased on December 1, 2016, and he’s told reporters that he will veto the recent House bill. But if he doesn’t, the new salary threshold won’t go into effect until June 1, 2017 – if it isn’t killed off entirely through some other legislative means.

Update September 7, 2017 – Obama’s Overtime Rule Dies In Court

Former President Obama’s ambitious proposal to double the overtime salary threshold will almost certainly never come to fruition, the National Law Review writes. A federal judge in Texas has ruled in favor of several business organizations, who filed suit against the Labor Department to challenge the agency’s plan to extend overtime eligibility to 4.2 million salaried employees. Even more decisively, President Trump’s Department of Labor has announced that it will not appeal Judge Amos Mazzant’s decision, leaving almost no hope for the rule’s implementation. To learn more about the ruling, click here.

As it stands, the old regulations will remain in force. Employees making at least $455 per week may be exempt from overtime, while salaried workers making fewer than $455 per week are generally entitled to overtime.

Exempt Job Duties

The third requirement for any “white collar” exemption is what you do at work, the Department of Labor reports. There are three basic exempt job descriptions and employers can’t pick and choose. These have to be your primary job duties.

- administrative – perform office (or other non-manual) work that is directly related to the business operations or management of their employer’s company and exercise independent judgment on matters of significance

- executive – manage their employer’s enterprise or a subdivision (department) within that enterprise and routinely supervise the work of at least two full-time employees and make significant contributions to hiring and firing decisions

- professional – have advanced knowledge in a field of science or learning (usually backed up by a post-undergraduate degree, like a Master’s) or perform work that requires originality, talent, imagination and invention in a recognized artistic field

Although more limited, some employees could fall into two other “white collar” exemptions, for computer specialists and outside salespeople. Think you fall into one of the exempt categories? You may be exempt, but only if you also make a salary and that salary is over the threshold. All three conditions are required. If you only meet two, you are likely entitled to overtime pay.

Employers take note: some states have passed laws that make it more difficult to classify employees as exempt under the “white collar” exemptions. Always check your state laws to make sure that you are compliant.

I’m Entitled To Overtime. How Much Should It Be?

Overtime usually amounts to 150% of a worker’s normal pay-rate, although in some weeks, employers will also need to factor in commissions and bonuses. This part can get tricky, since bonuses and commissions don’t usually take hours into account. In this case, we would have to do some more complicated calculations to arrive at your “straight-time compensation,” then calculate the proper overtime rate based on that number.

Let’s take Maria as an example. Maria normally makes $10 an hour. One week she works 46 hours to cover a friend’s shift. That’s 6 hours of overtime, but Maria is also getting a bonus of $60 this week, since she’s never missed a shift of her own. We’ve got to put all of these facts together to arrive at Maria’s straight-time compensation rate.

First, we’ll take Maria’s regular rate of pay ($10) and multiply it by her hours worked (46) to get $460. Next, we need to add in Maria’s bonus ($60). That gives us a total of $520, which is Maria’s straight-time compensation for the week. To find Maria’s regular rate for the week, we’ll divide her straight-time compensation ($520) by her hours worked (46). That equals around $11.30, and now we’re ready to calculate Maria’s overtime. Take that new regular rate ($11.30) and multiply it by 1.5 to get Maria’s new overtime rate, $16.95. This is how much Maria should be paid for her 6 overtime hours. She’ll be paid for the remaining 40 hours at her new regular rate, $11.30. Maria’s straight-time earnings are equal to $11.30 times 40, or $452. Her overtime earnings, equal to $16.95 times 6, are $101.70. Add those two numbers together and we get $553.70, which is how much Maria should be paid for the week’s work, including her overtime and her bonus.

If you don’t make a bonus or commission, your calculations will be a lot simpler. Let’s say that, like Maria, you make $10 an hour. Your overtime wage should be $15, or $10 times 1.5. Work 46 hours in a week and you should be paid straight-time earnings of $400 plus overtime of $90, for a total of $490. Time-and-a-half is an appropriate, and common, phrase used to get this point across.

When Do You Get Overtime?

The proper (and legal) way to calculate overtime is always by the week. According to the Fair Labor Standards Act, a federal law, workers are entitled to overtime wages for any and all hours worked over 40 in one workweek. A workweek is defined as “a fixed and regularly recurring period of 168 hours – seven consecutive 24-hour periods.” In other words, workweeks don’t need to start on Monday. Your own workweek can start on any day, as long as it lasts for seven consecutive days.

In most circumstances, overtime needs to be paid on the normal pay day for the pay period in which your overtime wages were earned. Get paid every Friday? Any week that you work overtime, your overtime wages should be included in Friday’s check. Of course, many employees are paid every two weeks – on a bi-weekly basis. That’s okay, but employers must calculate overtime wages for each of those weeks individually. They are not allowed to average two weeks together, although this is a common tactic used to wriggle out of overtime requirements.

Most states have wage and hour laws of their own, which operate in addition to the federal Fair Labor Standards Act. Normally, these state laws use a per-week basis for overtime requirements, just like the Fair Labor Standards Act. However, in California and a small selection of other states, lawmakers have made daily overtime a requirement, too. California’s law says that most workers should receive overtime pay for any hours worked over 8 in a single day, regardless of whether or not the worker spends more than 40 hours on the job in the same week. Like weekly overtime, these daily overtime wages should be paid on your regular pay day.