Share Our Wage Theft Infographic On Your Site

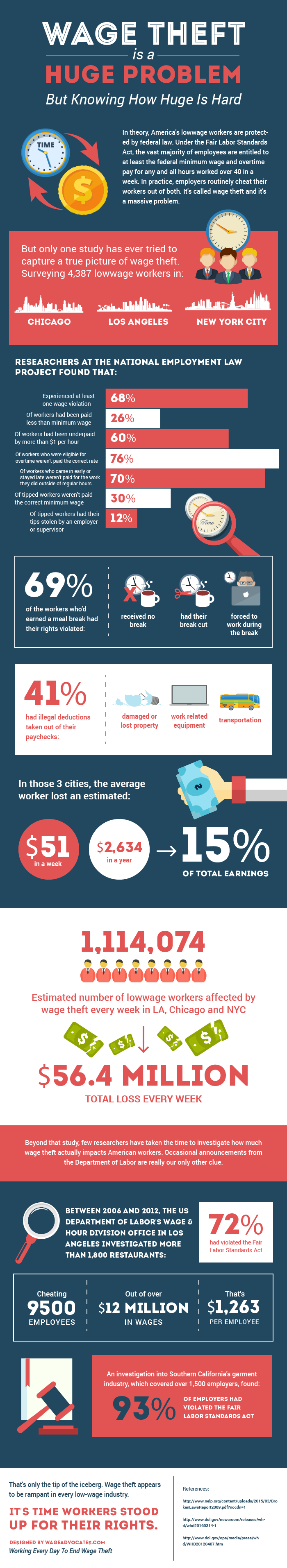

In theory, America’s low-wage workers are protected by federal law. Under the Fair Labor Standards Act, the vast majority of employees are entitled to at least the federal minimum wage and overtime pay for any and all hours worked over 40 in a week. In practice, employers routinely cheat their workers out of both. It’s called wage theft and it’s a massive problem.

68% Of Workers Hurt By Wage Theft, Study Finds

But only one study has ever tried to capture a true picture of wage theft. Surveying 4,387 low-wage workers in Chicago, Los Angeles and New York City, researchers at the National Employment Law Project found that:

- 68% experienced at least one wage violation

- 26% of workers had been paid less than minimum wage

- 60% of workers had been underpaid by more than $1 per hour

- 76% of workers who were eligible for overtime weren’t paid the correct rate

- 70% of workers who came in early or stayed late weren’t paid at all for the work they did outside of regular hours

- 30% of tipped workers weren’t paid the correct minimum wage

- 12% of tipped workers had their tips stolen by an employer or supervisor

69% of the workers who’d earned a meal break had their rights violated, either receiving no break, having their break cut short by work duties (but not receiving pay for that time) or just being forced to work during their “break.”

41% had illegal deductions taken out of their paychecks. In Illinois, New York and California, employers by-are-large aren’t allowed to take money out of a paycheck to reimburse themselves for damaged or lost property, work-related equipment or transportation. But in Chicago, NYC and LA, employers routinely were. Likewise, most states have laws that entitle workers to information on their earnings and deductions, whether they get paid by check or cash. 57% of workers didn’t get it.

In concluding their paper, the researchers worked out how much the average front-line worker in a low-wage industry lost to wage theft in any one of the three cities studied. Their result is staggering:

- $51 in a week

- $2,634 in a year

- 15% of total earnings

Stepping back to take a broader view, the researchers estimated that 1,114,074 low-wage workers were affected by wage theft in LA, Chicago and NYC, losing out on over $56.4 million in wages every week. If those numbers are anywhere close to accurate, wage theft is a far larger problem than anyone has been prepared to consider.

Stitching Together Labor Department Reports

Beyond that one study, few researchers have taken the time to investigate how much wage theft actually impacts American workers. Occasional announcements from the Department of Labor are really our only other clue. Between 2006 and 2012, the US Department of Labor’s Wage & Hour Division office in Los Angeles investigated more than 1,800 restaurants:

- 72% had violated the Fair Labor Standards Act

- cheating 9,500 employees

- out of over $12 million in wages.

That’s $1,263 per employee. A different investigation into Southern California’s garment industry, which covered over 1,500 employers, found that 93% of employers had violated the Fair Labor Standards Act. Some of those companies had even ordered special software, designed “to generate falsified payroll registers that displayed an appearance of compliance,” according to a Department Of Labor document made public on FairWarning.org after the investigation.

Kevin Choi, owner of E D Fashion, a garment contractor based in Los Angeles (and now suspended for failing to pay taxes, according to California Company List), paid $1,500 for the software – a pretty good investment, seeing as Choi eventually settled with California’s Labor Department for $350,000 in back wages.

The software, called “Global Production System,” took the piece rate earnings of workers and converted them into an hourly rate, then calculated spurious overtime wages, which were never paid out to employees, so the company’s payroll reports looked normal. Of course, E D Fashion had never even taken into account how long workers spent at their jobs, since it was actually paying them based on the number of garments they completed.

Do all companies use sophisticated technologies to actively cheat their employees? No, but some do. Other companies make legitimate mistakes, inaccurately interpreting federal regulations and paying their workers improperly as a result. There are white, black and gray areas, here, but at the end of the day, work deserves to be compensated and this country has laws in place to make sure that it is. Employers who violate those laws should be held accountable.